What are the attributes of a world-class investment portfolio that even Warren Buffett would bless?

Buffett’s 2013 letter to Berkshire Hathaway shareholders gives us a clue:

“The ‘know-nothing’ investor who both diversifies and keeps his costs minimal is virtually certain to get satisfactory results. Indeed, the unsophisticated investor who is realistic about his shortcomings is likely to obtain better long-term results than the knowledgeable professional who is blind to even a single weakness.”

Instead of instructing people to build a portfolio of hand-picked individual stocks, Buffett – like he has in previous shareholder reports – recommends that people start with a plain vanilla S&P 500 index fund (Nasdaq:VFINX).

Although an S&P 500 index fund or ETF (NYSEARCA:IVV) might be a good place for exposure to U.S. stocks, it’s only one component, among many others, for constructing a truly diversified portfolio.

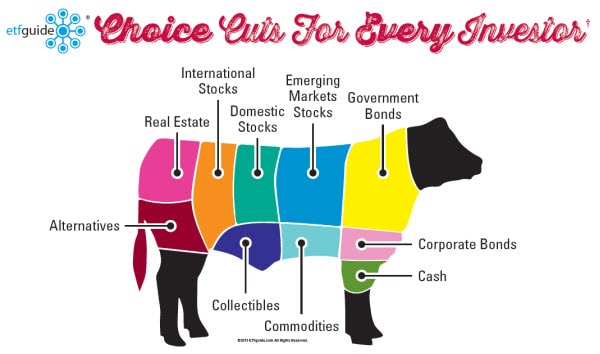

A few years ago, I gave up on dull diversification pie charts. Instead, I’ve been illustrating portfolio diversification as the various beef cuts of a cow. (See below)

At a very minimum, the diversified portfolio should also include other major asset classes like real estate (NYSEARCA:RWO), global treasury inflation protected securities (NYSEAARCA:GTIP), and bonds (NYSEARCA:LQD).

In my latest investing video, I explain the concept of a low cost index-based portfolio consisting of core investment holdings and how the major asset classes in my cow illustration integrates with that strategy.

I also analyze the role of non-core investment portfolios and what types of assets are held in them.

Index-based ETFs that are low cost and diversified pass the smell test for both sophisticated and unsophisticated investors alike. And making this the foundation of your serious money investments is a portfolio strategy that even the great Warren Buffett would approve.

The ETF Profit Strategy Newsletter uses technical, fundamental, and sentiment analysis along with market history and common sense to keep investors on the right side of the market. In 2013, 70% of our weekly ETF picks were gainers.

Follow us on Twittter @ ETFguide