How frightened to invest are people? So frightened, they’d rather die!

A poll taken by Harris Interactive for Nationwide Financial found that 62% of surveyed respondents are afraid of investing in the stock market while just 58% are afraid of dying.

Building your own investment portfolio from scratch is a fearful task for many people, but it doesn’t have to be that way.

In his 2013 letter to Berkshire Hathaway shareholders, Warren Buffett reveals a few secrets for building a smart investment portfolio:

“The ‘know-nothing’ investor who both diversifies and keeps his costs minimal is virtually certain to get satisfactory results. Indeed, the unsophisticated investor who is realistic about his shortcomings is likely to obtain better long-term results than the knowledgeable professional who is blind to even a single weakness.”

Buffett goes on to recommend that people start with a plain vanilla S&P 500 index fund (Nasdaq:VFINX) instead of throwing darts at individual stocks.

Beyond stocks, a well-built investment mix should have exposure to other major asset classes like global treasury inflation protected securities (NYSEAARCA:GTIP), commodities (NYSEARCA:GCC), and real estate (NYSEARCA:RWO). Remember: Although an S&P 500 index fund or ETF (NYSEARCA:IVV) might be good for exposure to U.S. stocks, it’s only one component among many others for building a truly diversified portfolio.

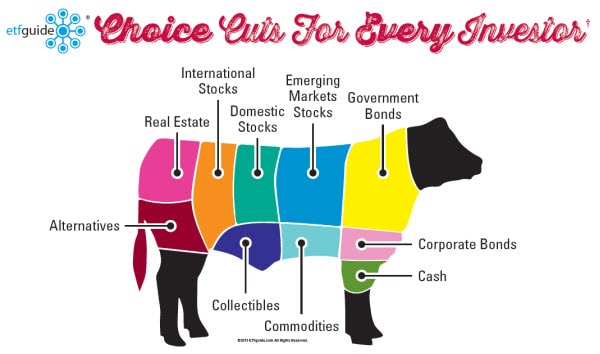

A few years ago, I gave up on dull diversification pie charts. Instead, I’ve been illustrating the ingredients for a well-built portfolio as the various beef cuts of a cow. (See below)

In a recent investing video, I explain the concept of how to build a simple and low cost investment portfolio with index ETFs as the primary ingredients. This represents the “core” or “foundation” of a person’s investment portfolio.

I also analyze the role of non-core investment portfolios and what types of assets are held in them.

The idea of “core” and “non-core” portfolio applies to both sophisticated and unsophisticated investors alike. Not only is it a relatively simple way to build your investments, but it can remove the fear out of making mistakes.

The ETF Profit Strategy Newsletter uses technical, fundamental, and sentiment analysis along with market history and common sense to keep investors on the right side of the market. In 2013, 70% of our weekly ETF picks were gainers.

Follow us on Twittter @ ETFguide