The highly publicized cyber-attack on Sony Pictures Entertainment in November 2014 is the type of greatly feared computerized catastrophe that all individuals and institutions face.

Although a personal cyber attack can be overwhelming, attacks at the corporate or government level can have dire consequences. In addition to financial losses, cyber attacks have the ability to shut down or manipulate energy infrastructure, weapons defense systems, medical devices, financial markets, and transportation networks.

(Audio) Portfolio Report Card: A Doctor with a Sick $503,000 Retirement Plan

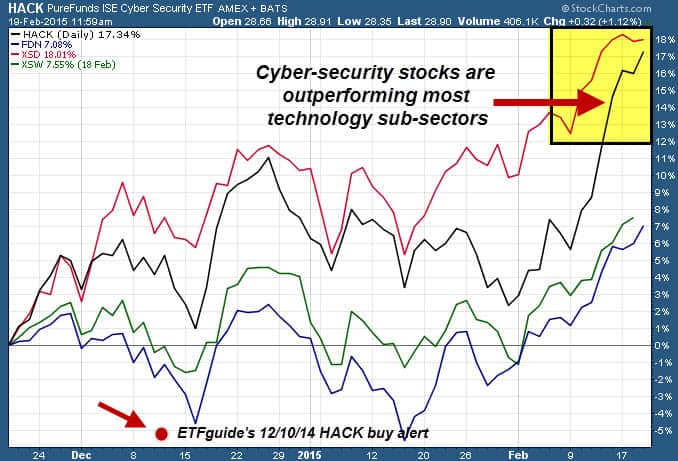

The PureFunds ISE Cyber Security ETF (NYSEARCA:HACK) invests in companies involved in this emerging industry sector and the chart below plots HACK against other sub-sectors within the technology space like Internet providers (NYSEARCA:FDN), semiconductor (NYSEARCA:XSD), and software makers (NYSEARCA:XSW).

HACK has gained around 17% over the past three-months and its on the verge of overtaking semiconductors. (See ETFguide’s original ETF research featuring HACK back on 12/10/14)

HACK follows a portfolio of 30 publicly traded companies that offer cyber security solutions including hardware, software and services. Among HACK’s top 10 holdings are Infoblox (NYSE:BLOX), KEYW Holding Corp. (NasdaqGS:KEYW), Proofpoint (NasdaqGM:PFPT), and FireEye (NasdaqGS:FEYE).

The U.S. accounts for almost 75% of HACK’s country exposure with Israel (12.21%), the Netherlands (5.23%), and Japan (3.90%) just behind.

HACK tracks the ISE Cyber Security Index and is rebalanced semi-annually. The index uses a modified equal weighting method which means that no single stock represents more than 20% of the weight of the index. Additionally, the cumulative weight of all components with an individual weight of 5% or greater do not in the aggregate account for more than 50% of the weight of the index.

As the globe becomes more interconnected, the frequency and scale of cyber-attacks is likely to increase. And the best insurance policy is prevention.

Follow us on Twitter @ ETFguide