Keeping track of global macroeconomic trends is a daunting task.

For that reason, each month we organize and rank the key market trends in our Mega Investment Theme Report by order of significance.

Here’s a few of this year’s biggest themes:

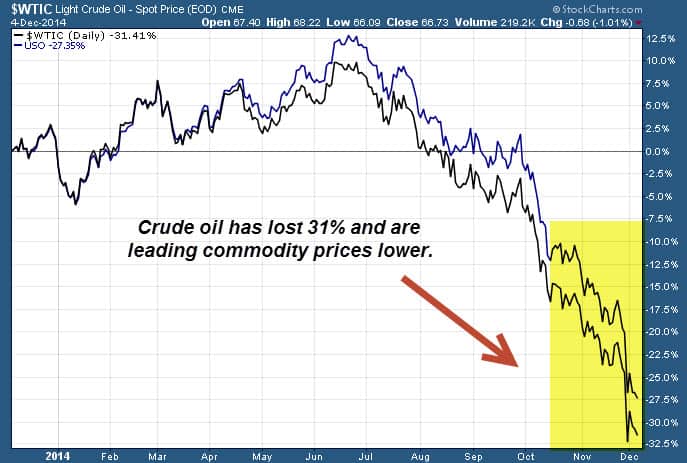

Commodities Get Crushed

All of the hyper-inflationary dreams of commodity bulls have been shot dead. As a group, commodities have fallen around 27% since 2011 and many individual sectors like oil (NYSEARCA:USO) are down more. Over the past year alone, light crude oil is 31% lower.

Even defensive oriented precious metals have gotten clobbered: The ETFS Precious Metals Basket (NYSEARCA:GLTR), which holds gold, silver, platinum, and palladium is down almost 29% over the past 4 years.

Healthcare Sector Blazes Ahead

The booming healthcare sector has been among this year’s biggest investment themes. S&P 500 healthcare (NYSEARCA:XLV) stocks are up 30% while biotech stocks (NasdaqGM:IBB) have jumped 39% since the start of the year. Both sectors are easily outperforming the broader U.S. stock market (NYSEARCA:VTI), which has gained 16.6% over that same time frame.

Long-Term Bonds Outperform Stocks

The yield on 10-year U.S. Treasuries (ChicagoOptions:^TNX) has shocked Wall Street by sliding 20% this year. Most analysts at the beginning of the year wrongly predicted higher yields and lower bond prices.

(Audio) Listen to Ron DeLegge @ The Index Investing Show

In March, we alerted readers via our timestamped Weekly ETF Picks that long-term U.S. Treasuries (NYSEARCA:TLT) would be the best way to profit from higher bond prices and lower yields. Since the beginning of the year, TLT – which follows long-term U.S. Treasuries has jumped by almost 23% while the SPDR S&P 500 (NYSEARCA:SPY) is up 14%.

The “R” in BRIC Gets Slaughtered

How bad have Russian stocks been this year? The Market Vectors Russia ETF (NYSEARCA:RSX) has been slammed 35% and the worst may yet be ahead. By comparison, the BRIC group (NYSEARCA:BKF) – which Russia is part of – along with Brazil, India, and China has a modest YTD decline of just 0.20%.

Shorting Russian stocks has been one of the best bearish trades of 2014. The Direxion Daily Russia Bear 3x Shares (NYSEARCA:RUSS) has soared around 100% YTD.

Follow us on Twitter @ ETFguide