Never mind how U.S. stocks are at all-time highs. People are pouring more money into stock tracking ETFs.

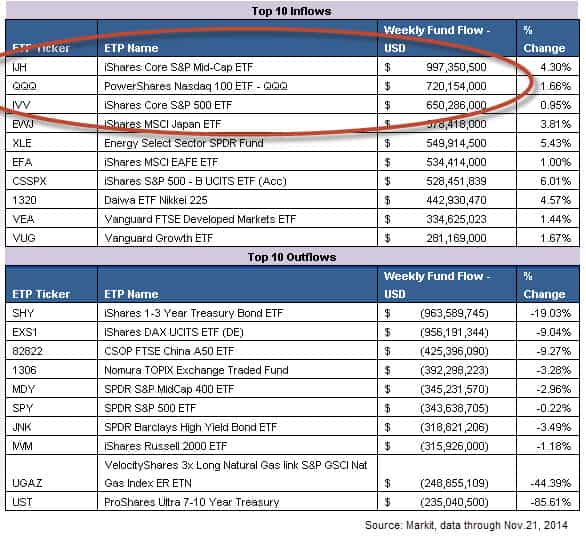

The top three ETFs by asset inflows over the past week were the iShares S&P MidCap ETF (NYSEARCA:IJH), iShares S&P 500 ETF (NYSEARCA:IVV), and the PowerShares Nasdaq 100 ETF (NasdaqGM:QQQ). IJH raked in almost $1 billion while QQQ brought in around $720 million, according to Markit.

Although the total U.S. stock market is up, small and mid size stock ETFs are underperforming large cap benchmarks year-to-date. The iShares Russell 2000 Small Cap ETF (NYSEARCA:IWM) is ahead by just 3.2% compared to a 13.78% gain for the SPDR S&P 500 ETF (NYSEARCA:SPY). Mid cap stocks have gained around 9.3%.

The S&P 500 is headed for its fifth consecutive yearly gain and ninth increase out of the past 10 years.

The largest weekly outflows were led by the iShares 1-3 Year Treasury Bond ETF (NYSEARCA:SHY), which suffered $963 million in outflows. In aggregate, investors yanked around $857 million out of fixed income ETFs.

Follow us on Twitter @ ETFguide