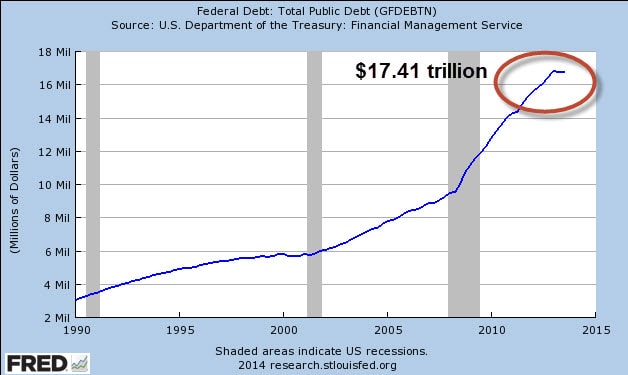

The Russell 2000 small cap index (NYSEARCA:IWM) just made a new all-time high, but stocks aren’t the only thing topping. U.S. public debt is at record levels too and heading higher.

Total outstanding public debt is now at $17.41 trillion, according to the U.S. Treasury Department’s latest daily statement. That’s almost $1 trillion over last year’s debt ceiling limit of $16.69 trillion.

The public’s total debt load will continue to climb, thanks to the suspension of the U.S. government’s borrowing limit until March 16, 2015. At the current pace of overspending, U.S. debt should top $18 trillion within nine months.

WATCH: Are Target Date Funds Good for Investors?

Despite the bull market in rising debt, the bond market has yet to panic because yields have fallen.

The yield on 10-year Treasuries (ChicagoOptions:^TNX) has calmly declined almost 12.6% since the start of the year and yields are hovering around 2.69%. Likewise, the yield on 30-year Treasuries (ChicagoOptions:^TYX) has quietly moved lower around 9% toward a yield of 3.62%. Treasuries, at least for now, have been the temporary beneficiary of capital fleeing away from emerging markets and other “risk on” assets.

Treasury bull ETFs that leverage daily performance to government bonds with durations longer than 20 years like the Direxion Daily 20+ Yr Treasury Bull 3x Shares (NYSEARCA:TMF) and the ProShares Ultra 20+ Yr Treasury ETF (NYSEARCA:UBT) have scored year-to-date gains between 14% to 22%.

The 12-month trailing yield for the Vanguard Total Bond Market ETF (NYSEARCA:BND), which holds almost half its fixed income exposure to U.S. government debt is at 2.49%.

Since 2007, total federal debt has almost doubled from just under $9 trillion.

The ETF Profit Strategy Newsletter uses technical, fundamental, and sentiment analysis along with market history and common sense to keep investors on the right side of the market. In 2013, 70% of our weekly ETF picks were gainers.

Follow us on Twittter @ ETFguide