While Wall Street and the mainstream media is enamored by one all-time high after another in the U.S. stock market (NYSEARCA:DIA), other key investment themes have largely been ignored or forgotten.

If the S&P 500 (SNP:^GSPC) stays the same or edges higher, it’ll mean five consecutive yearly gains and nine gains out of the past 10 years. These sizzling gains have led to an amazing mood reversal in the love/hate relationship investors tend to have with stocks from hate to love. This is further confirmed by the $21 million in investment portfolios (a microcosm) that we’ve analyzed and graded via our Portfolio Report Card service. Investment allocations to stocks are up big time!

(Audio) Listen to Ron DeLegge @ The Index Investing Show

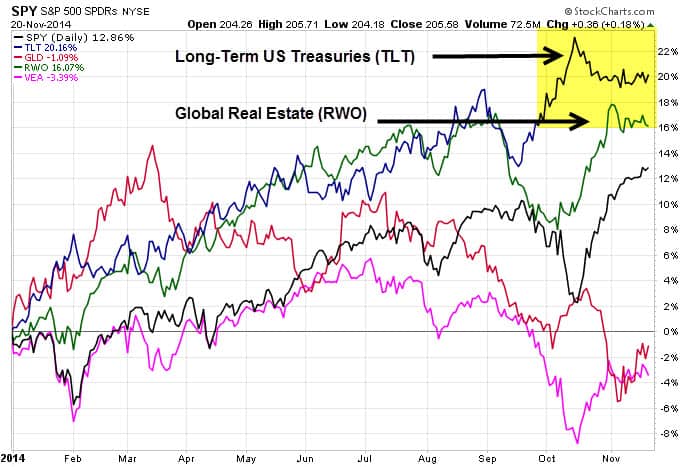

Even so, the real 2014 performance winners among the major asset classes have and continue to be long-term U.S. Treasury bonds (NYSEARCA:TLT) and global real estate (NYSEARCA:RWO). The chart below shows that 11 months into the year, ETFs linked to these two asset classes (long-term government bonds and global real estate) have gained 20.16% and 16.07% respectively easily outperforming the S&P 500, international developed market stocks (NYSEARCA:VEA), and gold (NYSEARCA:IAU).

Equally impressive is that both long-term government bonds and global real estate carry higher income or yields compared to the S&P 500 (NYSEARCA:IVV). That means on a total return basis – not just relative returns – both categories are crushing the broader U.S. stock market.

Follow us on Twitter @ ETFguide