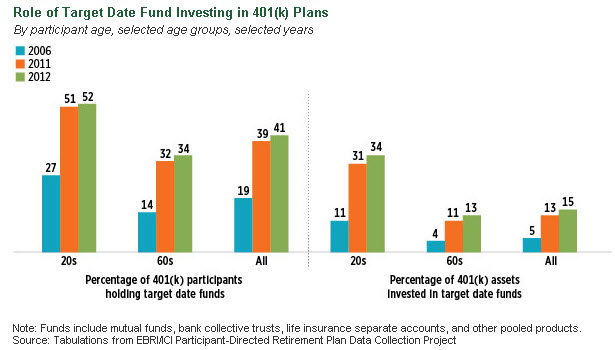

Around 41% of all 401(k) savers have are using target-date mutual funds (TDFs) and the numbers keep rising. Experts in the financial services industry applaud this trend, but are target-date funds really the panacea to a secure retirement income?

TDFs attempt to match a person’s age and risk tolerance with a projected retirement date. For example, the Vanguard Target Retirement 2050 Fund (Nasdaq: VFIFX) is aimed at people in their mid-20s, whereas the Vanguard Target Retirement 2035 Fund (Nasdaq: VTTHX) is designed for individuals in their 40s and the 2015 Fund (Nasdaq: VTXVX) is for people in their early 60s.

Investor Confusion

According to one study, around 30% of people believe the target date refers to the year in which the fund’s mix between stocks, bonds, and cash is the most conservative. In reality, the year in the fund’s name refers to the approximate year (the target date) when an investor in the fund would retire and stop investing in the fund. As they approach their designated target-date, funds gradually shift their investment mix from more aggressive investments like stocks to more conservative ones like bonds.

A major factor influencing the rise of target-date funds (Nasdaq:TRRDX) is the automatic enrollment of participants into their 401(k) plan and the plan sponsors’ decision to choose target-date funds as the default investment option.

Despite their noble attempt at helping people to save and invest for retirement, TDFs (Nasdaq:TRRBX) have many serious flaws that are being ignored or purposely hidden. Let’s examine three quick examples.

1) TDFs encourage the public to be lazy when it comes to asset allocation. A person’s first choice for their retirement investments should always be a customized asset mix that perfectly matches not just their age, risk tolerance, and goals, but their unique investor personality. Instead of delivering that, TDFs dish up a one-size fits all retirement plan as a default choice.

2) TDF fees are still too high. The average annual cost for TDFs are in the vicinity of 1%, which is ridiculously inflated for the amount of actual work these types of mutual funds do.

3) Most TDFs are grossly underdiversified because they miss market exposure to major asset classes like commodities (NYSEArca: GCC), global real estate, international bonds, and TIPS.

In my latest retirement investing video, I talk with Ron Surz, President at PPCA about other big problems with TDFs. Fiduciaries listen up!

Summary

It’s true that a TDF default choice is better than nothing, but it’s not better than a customized investment mix that perfectly matches a 401(k) participant’s unique investment needs and personality. Moreover, the fees being charged by most TDFs are excessive, which will greatly reduce the retirement income benefits of the people buying them.

Despite the so-called improvements to glide paths and other financial engineering to make them better, many TDFs have simply increased their market exposure to bonds, as a knee-jerk reaction to the stock market clobbering they took during the 2008-09 financial crisis. How will these TDFs perform when bond prices crash?

Follow us on Twitter @ ETFguide