Does your portfolio have a margin of safety?

I ask that question because the total U.S. stock market (NYSEARCA:SCHB) has been rocky over the past few weeks and now has a year-to-date (YTD) loss of -1.23%. And since most investor underperform the stock market and the index ETFs tied to it, it’s fair to assume many people have much worse performance.

(Audio) Listen to a Portfolio Report Card on a $1.5 million account for E.S. in Washington

The concept “margin of safety” was originally developed in the 1930s by Benjamin Graham and David Dodd, the founders of modern day value investing. Unlike today’s faceless generation of “roboadvisors” that have never experience a bear market, let alone survived one, Graham and Dodd lived through the Great Depression so they understood the importance of investing with safety.

Although their idea was applied to selecting individual stocks at undervalued prices, Dodd and Graham’s principles about safety are applicable to anyone with a portfolio of investments that owns not just stocks (NYSEARCA:VT), but bonds (NYSEARCA:JNK), real estate (NYSEARCA:VNQ), and even commodities (NYSEARCA:GSG).

Here are four things all individual investors need to understand about their portfolio’s margin of safety:

Installing a margin of safety within your portfolio should always happen before a negative event

In my online course “Build, Grow, and Protect Your Money: A Step-by-Step Guide,” I teach how the prudent investor does not wait for a market crash or another adverse global event to build a margin of safety within their investment portfolio. Rather, your portfolio’s margin of safety – just like an insurance policy – is purchased ahead of the accident or crisis in order to protect your capital. Investing money without a margin of safety, whether done deliberately or out of plain ignorance, is negligent.

Building an architecturally sound investment portfolio doesn’t happen by chance

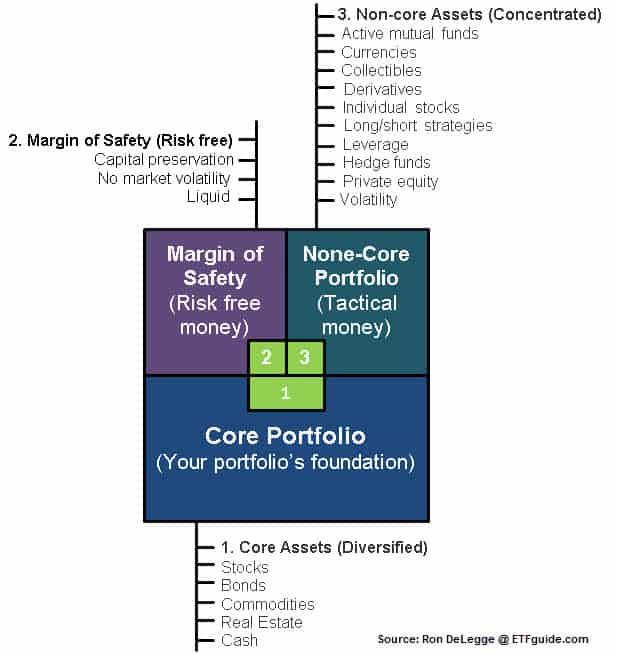

All structurally strong and healthy portfolio have three crucial parts: 1) the portfolio’s core, 2) the portfolio’s non-core, and 3) the portfolio’s “margin of safety.” (See image below) Each of these containers within your portfolio will complement each other by deliberating holding non-overlapping assets.

“I’m a long-term investor” or “the stock market always bounces back” is not prudent risk management

Some people have deceived themselves into believing their IRA, 401(k), or other investments require no margin of safety. This group of individuals generally believes they are too wealthy, too experienced, and too smart to have a margin of safety inside their portfolio. It’s a paradox too, because this same group that invests without a margin of safety (or insurance), has insurance (or margin of safety) on their automobiles, homes, and lives. Somewhere along the line, this group of people lacks the same prudent sense to protect their financial assets.

Investing in gold and bonds is not appropriate for your portfolio’s margin of safety

Many people along with certain financial advisors make the rookie mistake of believing that assets like bonds (NYSEARCA:BND) or gold (NYSEARCA:GLD) can be used for a portfolio’s margin of safety. Why is this approach fundamentally wrong? Because both bonds and precious metals – just like stocks and real estate – are subject to daily fluctuations and can lose market value. For example, anybody that bought gold at its height in mid-2011 is now down over 42% and should know from first hand experience that gold is an inappropriate tool for margin of safety money.

In conclusion, implementing your portfolio’s margin of safety should happen when market conditions are favorable, not when it’s raining cannonballs. And if you’re caught in the unfortunate situation where you failed to implement a margin of safety during good times and market conditions have deteriorated, the next most logical moment to implement your margin of safety is immediately.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.