A few months ago the NASDAQ Composite Index (Nasdaq:ONEQ) eclipsed 5,000 for the first time since March 2000. Put another way, we are all 15 years older since the NASDAQ’s first dance with all-time highs, but are we smarter? What did we learn from the first meltdown that can help us cope with future meltdowns?

After analyzing more than $100 million in investments with my Portfolio Report Card grading system, I can confidently say that risky and unsuitable portfolios for people at or near retirement is once again a reoccurring theme. Will history repeat itself?

This time around, the same kind of aggressive risk taking that characterized the investing public in the late 1990s and again the mid-2005s, is being aped once again. The main difference is that everyone is 15 years older and investment time horizons are shorter.

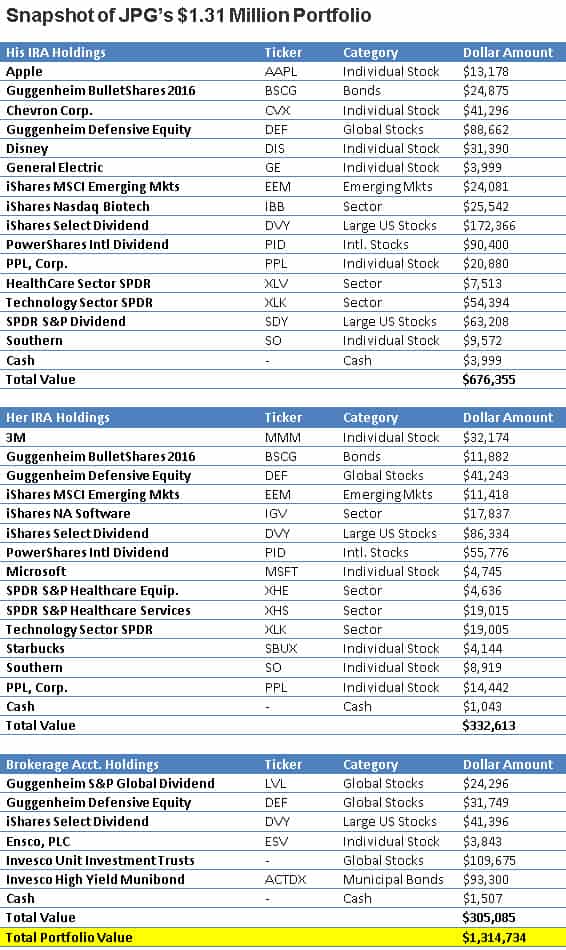

My latest Portfolio Report Card is for a married couple, JPG, living in Maryland. Both are in their late 60s and they asked me to grade their combined $1.31 million investment portfolio which consists of two traditional IRAs and joint brokerage account.

JPG explained to me they are not aggressive investors and want to have portfolio growth, but they need investment income to meet their daily living needs.

JPG’s portfolio is managed by a financial advisor who charges 0.89% annually. Do they have a healthy or unhealthy investment portfolio?

Let’s do a Portfolio Report Card for JPG and find out.

Cost

The prudent investor takes deliberate steps to minimize the negative impact of trading commissions, fund fees, and other frictional costs to the greatest degree possible. For income oriented investors that are retired like JPG, cutting cost is crucial because it directly impacts their cash flow and lifestyle.

(Audio) Investing, Gambling, and Pure Odds

The combined portfolios hold 12 ETFs, 9 individual stocks, 2 UITs, 1 mutual fund and cash. The asset weighted annual fund expenses on the mutual funds and ETF positions are 0.42% plus another 0.89% for advisory fees (1.31% total). In other words, JPG spends around $17,200 annually in investment advisory and fund fees, which are almost seven times higher versus a benchmark of index ETFs matching their same asset mix.

Diversification

Genuinely diversified investment portfolios always have broad market exposure to the five major asset classes: Stocks, bonds, commodities, real estate, and cash. How does JPG’s portfolio do?

It’s good to see JPG’s portfolio has exposure to US and international stocks (NYSEARCA:EFA), corporate bonds (Nasdaq:LSBDX), and cash. However, the portfolio has over-diversified exposure to healthcare and dividend paying stocks (NYSEARCA:DVY) by owning multiple funds that invest in the same area. Instead of helping JPG’s portfolio, it’s created a situation of unnecessary clutter.

Unfortunately, JPG’s portfolio lacks a core foundation that’s built on investments that are broad proxies of the asset classes where they invest. For example, although they own a corporate bond fund (NYSEARCA:BSCG), it’s not the type of holding that gives them complete coverage to the bond market. The same is true of their equity ETF holdings.

Additionally, JPG’s portfolio misses exposure to two major asset classes: real estate and commodities. For an advisor managed portfolio to have diversification this sloppy is wholly unacceptable!

Risk

The risk character of an investment portfolio should always be 100% compatible with a person’s capacity for risk and volatility (NYSEARCA:VXX) along with a person’s unique financial circumstances, liquidity requirements, and age. How does JPG’s portfolio do?

The overall asset mix of JPG’s combined portfolio is the following: 96.5% stocks, 3% bonds, and 0.5% cash. Unfortunately, this asset mix is not compatible with how JPG described themselves as balanced income investors. This is clearly a hyper-aggressive portfolio focused on growth. Furthermore, the the portfolio’s exposure of 96.5% equities is not age appropriate for late 60s investors.

Here’s another perspective on the excessive risk of JPG’s portfolio: A 20% to 40% stock market (NYSEARCA:IVV) decline would subject the combined portfolios to potential market losses of $249,000 to $500,000. What kind of anguish and radical lifestyle changes would losses of this magnitude cause JPG? Without a doubt, JPG needs to rethink their relationship with the financial advisor that assembled this unsuitable asset mix.

Tax Efficiency

Well-built investment portfolios are always aggressive at cutting the threat of taxes. This can be accomplished by owning tax-efficient investment vehicles along with proper asset location.

JPG told me their plan is to defer paying taxes on their IRAs by waiting a few more years to draw on their retirement funds until mandatory required distributions kick in at age 70 1/2. This is a good strategy and hopefully market returns will reward their patience.

Their taxable brokerage account has exposure to municipal bonds that generate tax-free income, which shows some semblances of an attempt to reduce the negative impact of taxes.

Performance

Investment performance will either validate or invalidate your portfolio’s design. And satisfactory performance is a direct result of controlling cost, taxes, risk and diversification.

JPG’s portfolio gained $38,497 and grew +3.1% from May 2014 to May 2015 compared to a gain of +10.64% for the index benchmark matching this same asset mix. Sadly, JPG’s one-year performance return was substantially less and is unsatisfactory.

The Final Grade

JPG’s final Portfolio Report Card grade is “D” (poor). Although tax-efficiency was their strongest grading category, their portfolio flunked in three other key categories: cost, risk and performance.

The fact that a portfolio like JPG’s with such high equity exposure (96.5%) performed so poorly during a period of strong performance in the stock market further is shocking and confirms this $1.31 million portfolio has significant flaws.

Ultimately, JPG’s diversification is sloppy, misses major asset classes like real estate, and lacks portfolio building blocks with broad coverage. The advisor who assembled this portfolio hasn’t earned their fees and should be ashamed of their shoddy work.

In summary, if JPG fixes the weaknesses within their portfolio that we identified, it’s hopeful that satisfactory performance with lower risk and cost will follow.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.