Building an architecturally sound investment portfolio doesn’t happen by chance.

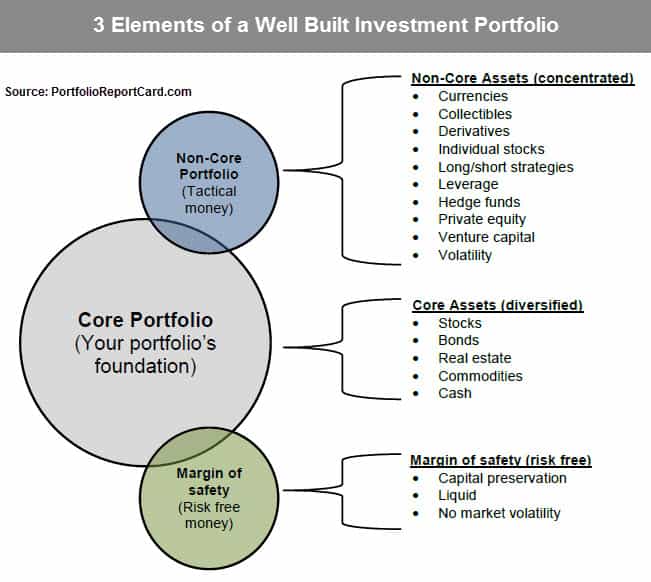

A structurally strong and healthy portfolio is organized into three basic parts: 1) the portfolio’s core, 2) the portfolio’s non-core, and 3) the portfolio’s “margin of safety.” All portfolio parts complement each other by deliberating holding non-overlapping assets.

(Audio) $1,000 Gold? + a $1.8 Million Portfolio Report Card

Let’s talk about the part of the portfolio that represents the “margin of safety.”

The concept “margin of safety” was originally developed in the 1930s by Benjamin Graham and David Dodd, the founders of value investing. Their idea was applied to selecting individual stocks at undervalued prices to help people become better investors.

In the context of the individual investor, the “margin of safety” represents the capital or money that a person absolutely cannot afford to risk to potential market losses. Like an insurance premium, this money gets set aside from a person’s core and non-core portfolio to be invested in fixed accounts with principal protection and liquidity.

Some people have deceived themselves into believing their investments require no margin of safety. This group generally believes they are too wealthy, too experienced, and too smart to have a margin of safety inside their portfolio. Ironically, this same group of people that invest without a margin of safety (or insurance), have insurance (or margin of safety) on their automobile, home, health, and life. Why is there an illogical disconnect between the need to protect physical assets, while simultaneously ignoring the financial ones?

“I’m a long-term investor” or “the stock market always bounces back” are common excuses for investing without a margin of safety. Unfortunately, both of these techniques are not a credible form of portfolio risk management. Diligent and proper risk control is always proactive versus being passive or reactive.

Others may claim that investing in bonds (NYSEARCA:BND) or physical assets like gold (NYSEARCA:GLD) is their portfolio’s margin of safety. This too is erroneous. Why? Because bonds (NYSEARCA:BOND) and precious metals (NYSEARCA:GLTR) are subject to daily fluctuations just like stocks (Nasdaq:QQQ) and can lose market value. Gold’s (NYSEARCA:IAU) almost 40% loss in value since mid-2011 is a tough lesson on why you shouldn’t use assets that are prone to market losses as a form of portfolio insurance. Similarly, those who have invested in long-term treasuries (NYSEARCA:TLT) as a form of portfolio insurance have suffered losses near 8% over the past three-months alone!

When is the best time to implement your portfolio’s margin of safety?

Like insurance coverage, the prudent investor acquires a margin of safety within their investment portfolio before they need it. Put another way, the timing of when you implement your portfolio’s margin of safety is mission critical.

Think about it this way: Would it be logical to attempt to buy insurance coverage after you’ve already had an automobile accident or after your home has been destroyed? Of course not! Similarly, would it be logical to implement a margin of safety after your portfolio has suffered catastrophic losses? Of course not! To be fully protected, you must prepare ahead.

In summary, implementing your portfolio’s margin of safety should happen when market conditions are favorable, not when it’s raining cannonballs. And if you’re caught in the unfortunate situation where you failed to implement a margin of safety during good times and market conditions have deteriorated, the next most logical moment to implement your margin of safety is immediately.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.