Is pessimism about the stock market really as high as equity bulls claim?

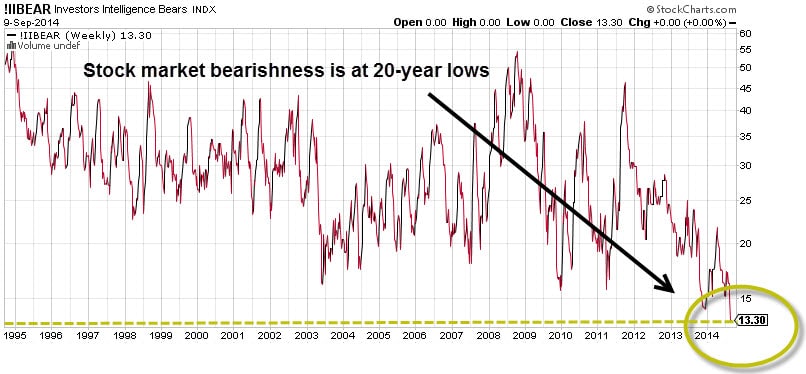

One measure of the stock market’s mood is the Investor’s Intelligence Sentiment Index, which offers us a compact view of how market participants feel toward stocks.

The latest II data shows that bearish sentiment or pessimism toward stocks (NYSEARCA:IVV) has now hit 20-year lows, near 13.3. While this is just one data point, it coincides with a lack of volatility and the S&P 500 Volatility Index (ChicagoOptions:^VIX) which is also near multi-year lows.

AUDIO: Listen to Ron DeLegge @ The Index Investing Show

Stretching back even further, current sentiment readings have matched Feb. 1987 lows in bearishness toward stocks.

Looking back, that served as a great setup and warning sign for anybody who bothered to pay attention. Just eight months later, the Dow Jones Industrial Average (NYSEARCA:DIA) suffered its largest one day percentage decline of -22.61% on Oct. 19, 1987.

Current sentiment readings do suggest a very high level of optimism toward stocks. How long will it last?

Sentiment extremes (NYSEARCA:VXX) can persist for extended time frames, but they never persist indefinitely.

History teaches us that sentiment extremes, regardless of whether they’re bullish (NYSEARCA:SPXL) or bearish (NYSEARCA:SPXS), invariably point to major turning points in financial markets.

The ETF Profit Strategy Newsletter uses technicals, fundamentals, discipline and common sense to find opportunities that others miss.

Follow us on Twitter @ ETFguide