Two questions: How wrong have experts been about the gold market this year? And how much money has their bad advice cost people?

Let’s tackle the first question, by extracting and analyzing some recent headlines:

“Gold Miners Fail to Launch” – Forbes, 5/14/14

“Gold Vulnerable to Manipulative Selloff in June” – Max Keiser, 5/30/14

“Why I Still Hate Gold” – James K. Glassman, Kiplinger, 6/4/14

“Pisani: Gold Can’t Get Traction” – NBC News, 6/4/14

“Kiss Gold Market Good-Bye” – Bloomberg, 6/4/14

All of these headlines hit the wire, just as the gold (NYSEARCA:GLD) and silver (NYSEARCA:SLV) market were in the midst of hitting multi-month lows. The same is true for stocks in the gold mining sector (NYSEARCA:JNUG). It was also during this same period, the market’s sentiment toward precious metals (NYSEARCA:GLTR) turned excessively bearish.

LISTEN: Listen to Ron DeLegge @ The Index Investing Show

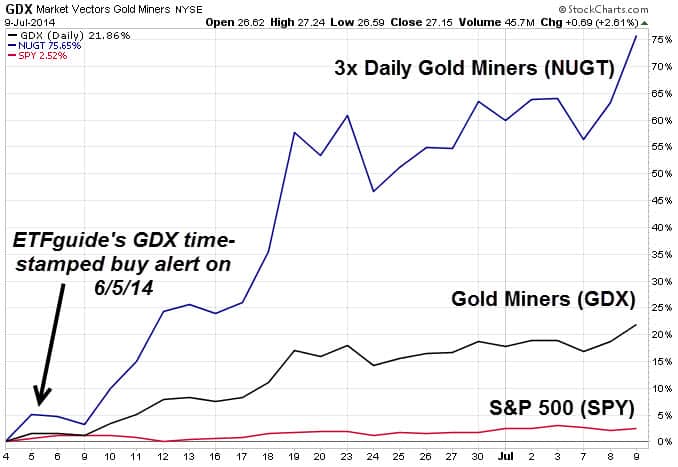

While all of these big-mouthed experts were telling you to sell or avoid gold (NYSEARCA:UGL) and the mining sector (NYSEARCA:NUGT), we told our readers to do the exact opposite. We said to our subscribers via ETFguide’s Weekly Picks on 6/5/14:

“When sentiment extremes are this bearish, more often than not it signals a reversal turning point and a buying opportunity. Although the Market Vectors Gold Miners ETF (GDX) has performed about twice as bad as gold itself over the past three months , we’re buying GDX shares at $22.50. Our tandem options trade is to buy the GDX JUL 22 call options (price and expiration reserved for subscribers) at around $100 per contract. We like the odds of a short-term gold bounce, especially if the equity market experiences its long overdue correction. And if GDX follows its historical pattern, it should outperform gold to the upside.”

Media people aren’t the only ones who’ve been dead wrong about precious metals. Even Wall Street’s big shots have missed. The “Great Vampire Squid” (Goldman Sachs) just reiterated its gold forecast of $1,050 per ounce by year-end.

How much money have people lost from the bad advice of experts? Looking at the missed opportunity cost is one way to measure it. Our unleveraged GDX trade has already gained over +21% since our 6/5/14 alert, NUGT is +75% and and our tandem GDX July call options trade booked a +188% gain.

News headlines are a wonderful contrarian indicator and when the market’s mood along with technical patterns align, it’s a great opportunity to pounce.

The ETF Profit Strategy Newsletter turns fundamental analysis upside down on its head. We use proprietary indicators, discipline, and common sense to find opportunities that others miss. Subscribers get text and email alerts along with actionable trades.

Follow us on Twitter @ ETFguide

P.S. ETFguide trades the gold market both ways and in 2013, a +525% GDX June 2013 put options trade was our biggest gainer. Ask us for the report.