Crude oil prices (NYSEARCA:USO) have crashed 50% over the past 9-months and energy stocks (NYSEARCA:XLE) were the only S&P 500 sector to post a loss in 2014.

The bear market in energy commodities (NYSEARCA:JJE) has prompted certain Wall Street analysts to argue that energy and oil stocks (NYSEARCA:XOP) represent a good value. Is the beaten up energy sector a screaming bargain?

(Audio) Listen to Ron DeLegge @ The Index Investing Show

FactSet reports:

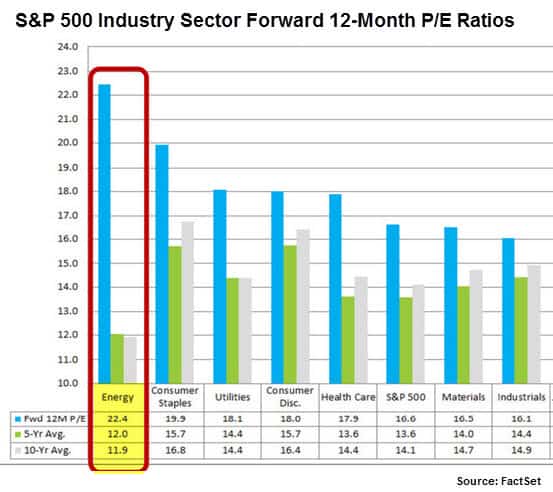

“The current forward 12-month P/E ratio for the Energy sector is now well above the three most recent historical averages: 5-year (12.0), 10-year (11.9), and 15-year (13.6).”

Put another way, the current 12-month forward P/E ratio for S&P 500 energy stocks (22.4) is double the 10-year historical average. That’s not exactly bargain territory.

Furthermore, energy stocks (NYSEARCA:OIH) still have the most frothy forward looking valuations (22.4) compared to all other S&P sectors. Even the usually expensive technology sector (NYSEARCA:XLK) has cheaper 12-month forward P/E values. Only consumer staples (NYSEARCA:XLP) and utilities are behind energy in terms of elevated valuations. The difference is that XLP gained 15.72% and XLU gained 28.73% over the past year, while XLE fell 8.40%. (The Jan. 2015 issue of the ETF Profit Strategy Newsletter has further in-depth coverage of energy ETFs.)

What about earnings?

Here too, Wall Street’s analysts continue to badly miscalculate.

At the end of Q3 2014,the estimated earnings growth rate for the energy sector for Q1 2015 was 3.3%. By December 31, the estimated growth rate cratered to -28.9% and today it’s near -54%.

Bottom line: If you’re looking for depressed sector valuations, look elsewhere.

Follow us on Twitter @ ETFguide