Years ago John Bogle once quipped, “If the data do not prove that indexing wins, well, the data are wrong. ” Here’s the latest: There’s no need to second guess Bogle on this particular matter because a) the data proves indexing wins, and b) the data is completely right.

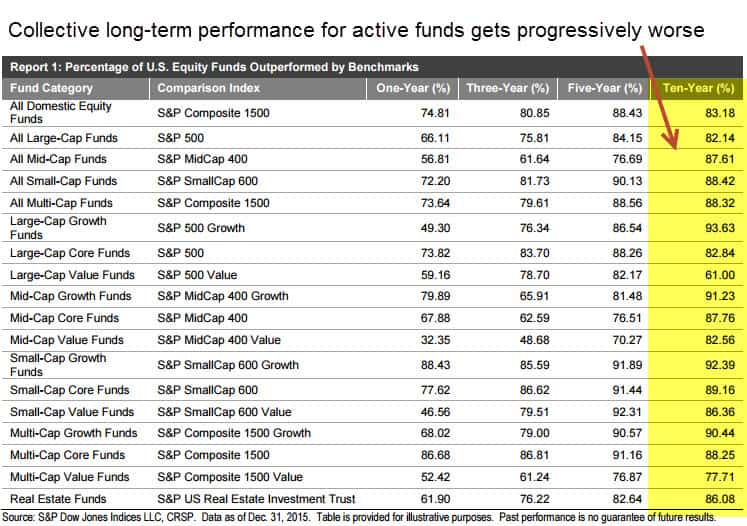

The table below shows the 1, 3, 5, and 10-year performance of actively managed mutual funds in multiple equity categories against dumb brainless indexes. Allow me to highlight a few notable trends.

First, the underperformance by equity managers is has occurred during both favorable and unfavorable markets. The typical argument is that active managers “protect” shareholders during a market crash because they don’t have to be fully invested like an index ETF. However, even with this alleged handicap, the performance of “fully-invested” index ETFs has thoroughly whipped active managers.

(Audio) Talking ETFs with Author Eric Balchunas + a $477,000 Portfolio Report Card

Second, the vast majority (more than 50%) of actively managed mutual funds in all categories are underperforming during all recorded periods – 1, 3, 5, and 10-years. And while it’s true there are a few equity categories with outliers, like U.S. large cap growth (NYSEARCA:VUG), U.S. large cap value (NYSEARCA:VTV), and U.S. small cap value (NYSEARCA:VBR), the performance discrepancies favoring active managers are far too small and short-lived to declare a convincing victory.

The other notable and alarming trend is how the collective performance of active managers gets progressively worse over longer-term horizons.

For example, Standard & Poor’s data shows that 74.81% of all domestic U.S. stock funds failed to beat the S&P Composite 1500 (NYSEARCA:ITOT) in 2015, while 80.85% failed to do it over a three-year period and whopping 83.18% failed during a 10-year period. The same trend of worsening performance is occurring in most other equity categories too.

Fast forward to now. Have money managers suddenly improved?

CNBC just reported that “Stock pickers had their worst quarter EVER.” How bad has it been? It’s been “history-making bad,” according to the journalists, with fewer than 1 in 5 large cap mutual funds beating the S&P 500 (NYSEARCA:IVV).

Regardless of the facts, misinformed mutual fund salespeople will still try to sell you the propaganda they know the identity of which tiny percentage of actively managed funds will outperform in the future. The truth is they don’t know and neither do the wonderful charts of historical performance they’re schmoozing you with. Why? Because accurately predicting which managers will outperform in the future is a total crap shoot. And that crap shoot is further increased by the sales loads attached to the funds they want to sell you. And besides that, today’s hotshots are tomorrow’s turkeys. (See David Einhorn, William Ackman, John Paulson, and the long-list of ex-wonder kids.)

The main point I want to convey is this: The proper and only context for actively managed funds of any sort is inside a person’s non-core investment portfolio. The non-core is higher risk and always smaller in size compared to a person’s core portfolio.

Among the $125 million in Portfolio Report Cards I’ve done thus far, I have yet to analyze and grade a portfolio with active funds being used for its core or foundation that have achieved satisfactory scores. If this describes your portfolio, please come forward because I want to dissect the evidence.

In the end, the debate of active vs. passive management is officially dead. And it will be that way, until the collective performance of active managers stops getting worse.