What’s hot and what’s not?

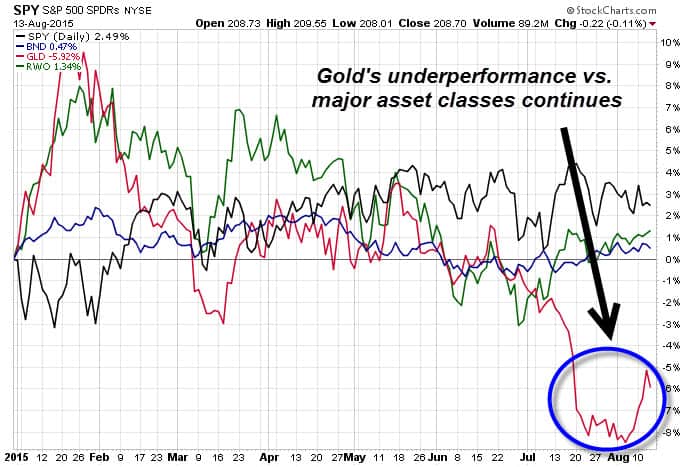

The chart below shows that U.S stocks (NYSEARCA:SPY) are still outperforming other asset categories like bonds (NYSEARCA:BND), global real estate (NYSEARCA:RWO), and gold (NYSEARCA:GLD) this year. Stock market fear is contained and the VIX – a popular barometer of sentiment – has declined around 30% year-to-date.

In terms of S&P 500 industry sectors, healthcare stocks (NYSEARCA:XLV) have jumped 10.62% while consumer discretionary stocks (NYSERCA:XLY) are up 9.25%.

In my latest Index Investing Show podcast, I tell an incredible story about how one technology entrepreneur lost his $700 fortune because of poor risk management. What went wrong? His financial negligence will blow you away and is a lesson on what not to do.

Also, I chatted with Andy Martin at 7Twelve Advisors about his new book Dollar Logic: A 6-Day Plan to Achieving Higher Returns by Conquering Risk. I read the book’s galley version and it’s jam-packed with financial gems, including a complete debunking of the popular myth that higher risk leads to higher returns.

As the chart above shows, the underperformance of gold this year is especially noteworthy because it’s occurred on the back of another European bailout crisis with Greece, collapsing oil prices and a crash in China’s A-shares market (NYSEARCA:ASHR).

Although gold is often promoted as a safe-haven that will hold up during turbulent markets, it’s actually lost value and hasn’t been an effective hedge during 2015’s upheaval. It’s another reason why I’ve been telling you that using gold for your portfolio’s margin of safety is a huge mistake. Remember: Assets that can lose market value should never be used in your portfolio’s margin of safety bucket.

Finally, even though fanatical types claim that GLD isn’t physical gold, it still doesn’t change the fact that GLD is a close proxy for physical gold prices. Each share of GLD approximately reflects 1/10 the ounce price of gold bullion and the LBMA Gold Price PM is the benchmark used.

Follow us on Twitter @ ETFguide