World-class investment portfolios deliberately minimize taxes and investment costs. Likewise, a well-built portfolio is handcrafted to perfectly match the unique investor personality of the individual.

Since May, I’ve already executed Portfolio Report Cards on $10.6 million in investments and too many investors are still coming up short.

This time around, my latest Portfolio Report Card is for S.G., a single, 45-year old mortgage underwriter (yes they still exist!) from Ohio. He told me his main goal is to retire at age 60 and his biggest worry is having adequate savings to cover his expenses including health insurance.

AUDIO: Listen to Ron DeLegge @ The Index Investing Show

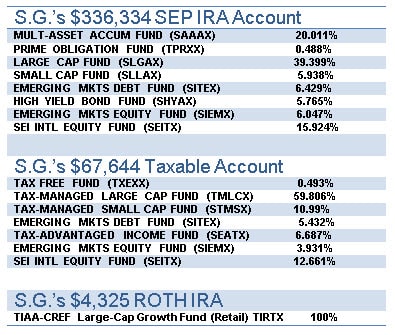

S.G. owns a total of 16 mutual funds divided among a SEP IRA, Roth IRA, and taxable investment account. He categorizes himself as an “aggressive” investor and he pays a financial advisor 0.75% annually to have his investment accounts managed.

What kind of grade will S.G.’s Portfolio Report Card be? Before I give him a final grade, let’s examine five key aspects of his investments and see how he does.

Diversification

Diversified portfolios always have exposure to all the core or major asset classes. How does S.G. do?

S.G.’s SEP IRA account holds U.S. large-cap stocks (Nasdaq:SLGAX), international stocks (Nasdaq:SEITX), emerging market stocks (Nasdaq:SIEMX), high yield bonds (Nasdaq:SHYAX), and a very small position in cash (Nasdaq:TPRX). He also owns a strategically oriented mutual fund that owns various bonds along with international and U.S. stocks called the SEI Multi-Asset Accumulation Fund (Nasdaq:SAAAX).

Although none of S.G.’s investment accounts own real estate, he covers himself by owning an 11-unit apartment rental with a $1.2 million value.

S.G.’s ROTH IRA has exposure (again) to large cap U.S. stocks and his taxable account also owns a few fixed income funds and more exposure to U.S. stocks.

Overall, his portfolio suffers from over-diversification by owning too much of the same thing; large-cap and small-cap U.S. stocks. Also, commodities and TIPS are two areas where S.G.’s portfolio misses.

Risk

S.G. characterizes himself as an aggressive investor and I think his 73% exposure to stocks in his SEP IRA, his 87.4% exposure stocks in his taxable account, and his 100% exposure to stocks in his ROTH IRA are an accurate reflection of someone who is “aggressive.”

One of the ongoing problems all investors face is the subtle differences between our risk perceptions and our actual tolerance to market risk. Usually, we learn about this the hard way; after the stock market falls 20% or more and we belatedly realize our risk tolerance was substantially less than what our risk perceptions told us. Will this turn out to be S.G.’s case?

Cost

The three largest holdings in S.G.’s SEP IRA are SAAAX, which charges annual expenses of 1.17%, SLGAX which charges 0.89%, and SEITX at 1.25%. The largest holdings inside his taxable account and ROTH IRA charge annual expenses from 0.85% to 1.25%.

Not only are his mutual fund fees elevated, but he’s paying another 0.75% annually to an advisor, which puts his annual investment costs closer to 1.5% to 2%. Yikes!

Tax-Efficiency

Some investors are so distracted by the need for smart asset allocation, that they completely ignore the importance of having smart asset location.

WATCH: Own Mutual Funds? Avoid these Blunders!

Thankfully, S.G.’s portfolios have some semblances of the need to purposely minimize taxes, but with a few contradictions. While he owns a tax-free income fund (Nasdaq:TXEXX) and tax-managed equity funds inside a taxable account, he simultaneously owns an emerging markets debt fund with a tax cost ratio of 1.4% – which makes it an ill-suited candidate inside the same taxable account.

Performance

I get really concerned when I grade investment portfolios that are unable to match or exceed the performance of a blended mix of passive index funds or ETFs. It’s a major red flag.

From July 2013 to July 2014, S.G.’s investment portfolio gained 12.3% while a portfolio of passive index ETFs that reflect an aggressive investor that matches his profile gained 16.53% with annual fees of just 0.18%.

Summary

S.G.’s final Portfolio Report Card is a “C.” His subpar performance over the past year – during a favorable stock market climate – is telling.

The high cost of his mutual funds is weighing down his portfolio. Furthermore, his portfolio is over-diversified – particularly with his exposure to large-cap and small-cap U.S. stocks. One would expect a lot more from an advisor managed portfolio.

Portfolios with a “C” have structural flaws that require major adjustments. Hopefully, S.G. can fix what’s wrong with his portfolio and get back on track.

Ron DeLegge’s Portfolio Report Card challenge stands: If your investment portfolio scores an “A”, you’ll get paid $100. Ron grades family trust accounts, 401(k) rollovers, 457 plans, 403(b), UGMA accounts, and anything posing as an “investment.”

Follow us on Twitter @ ETFguide