People do the darndest things. For example, they put their investments in places where they don’t belong.

This is a common problem suffered not just by retail investors, but by experienced professionals who are hired to advise them. In each case, there’s a poor understanding about the basic elements of a well-built portfolio. (In extreme cases, there may be knowledge of these basic elements, but an undisciplined framework or a perverted investment philosophy that prevents proper execution.)

(Audio) Portfolio Report Card for BB’s $1.23 Million Portfolio + 3 Rules for Trading Leveraged ETFs

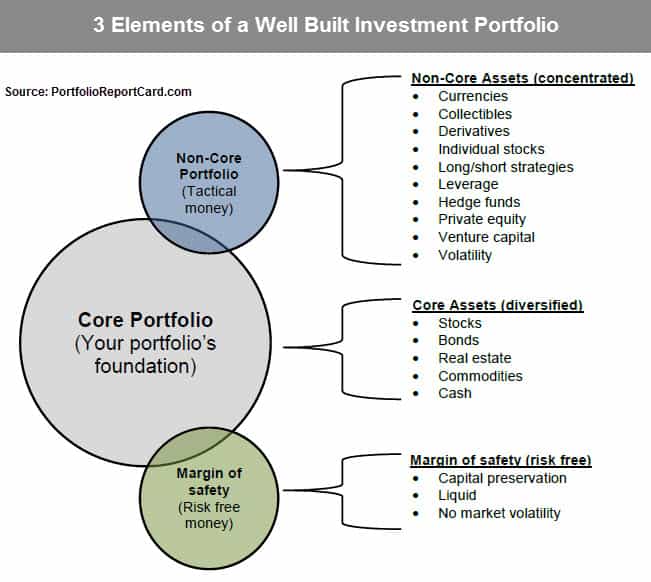

The figure below illustrates the three key elements of an architecturally sound portfolio: An investment portfolio’s core, it’s non-core, and its margin of safety. Together, these three distinct mini-portfolios are the framework for a person’s total portfolio.

Did you notice how each of these three separate portfolio parts deliberately owns non-overlapping assets? Did you also notice how the core portfolio is the largest circle or largest part of a person’s total portfolio?

When a non-core asset like an individual stock, currency, or collectible is or is permitted to become the largest asset within a person’s investment portfolio, do you know what happens? They’ve misplaced that asset by putting into a place where it shouldn’t be; inside their core portfolio.

The core part of a person’s portfolio is always the largest part of these mini-portfolios and is divided across the five major asset classes: stocks (NYSEARCA:SPY), bonds (NYSEARCA:BOND), real estate (NYSEARCA:ICF), commodities (NYSEARCA:GSG), and cash (Nasdaq:SWMXX).

Finally, the investment vehicles used to track these five core asset classes should be accurate proxies of the asset classes where they invest, broadly diversified, tax-efficient, and low cost.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s personally analyzed and graded more than $100 million in investment portfolios using his Portfolio Report Card grading system which helps people to identify the strengths and weaknesses of their IRA, Roth IRA, and 401(k) plan investments.

Follow us on Twitter @ ETFguide