The age of not having a believable investment plan is over. But that still hasn’t solved the problem of having too many investment choices. That leaves the prudent investor with no other option but to establish a logical framework that increases the odds of investment success. What should you do before buying your next individual stock?

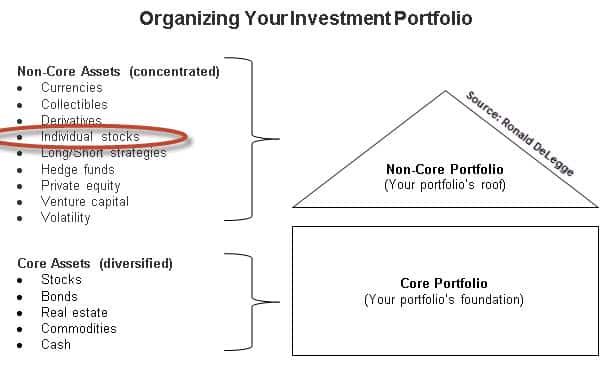

The below illustration – taken from my upcoming book – illustrates how an architecturally sound investment portfolio is organized into two basic parts; 1) the portfolio’s core (foundation) and 2) the portfolio’s non-core (roof). Both portfolio parts complement each other by deliberating holding non-overlapping assets.

(Audio) Listen to Ron DeLegge @ The Index Investing Show

The prudent investor’s priority is not to locate next year’s hottest stocks, funds, and ETFs – but rather, to first build the foundation or “core” of their investment portfolio. This phase or first step is comparable to constructing a home. You begin with the foundation on a solid footing and finish the structure with the second floor and roof. You cannot build an structurally sound building (or investment portfolio) without first completing your foundation.

As the above illustration shows, your portfolio’s foundation should be spread across the five major asset classes: 1) stocks (domestic, international, and emerging markets) (NYSEARCA:VT), 2) bonds (corporate and government debt along with global TIPS) (NasdaqGM:BNDX), 3) real estate (domestic and international), (NYSEARCA:VNQI) 4) commodities (NYSEARCA:DBC), and 5) cash. The investment products that you use to get market exposure to these core asset classes should have the following characteristics: 1) They should be broadly diversified proxies of the asset class they are tracking, and 2) they should be low cost.

What about individual stocks? Unless you’ve already built the foundation or core of your investment portfolio, you have no business owning individual stocks. Why? Because doing so is like building a house without a foundation. Living in that type of structure would undoubtedly put your life at risk. The same principle applies to your portfolio.

Remember: Individual stocks are always contained within your non-core investment portfolio along with other non-core assets like collectibles, currencies, private equity (NYSEARCA:PSP), and venture capital. Your non-core investment portfolio owns higher risk assets and is strictly complimentary to your core portfolio. For most people, the bulk of their investable assets will be located inside their core portfolio.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan. Does your portfolio pass or fail?

Follow us on Twitter @ ETFguide