Fragility in nature is a dangerous characteristic.

Dinosaurs, for example, were large and powerful, but they still died off. Why? While there’s no shortage of theories about what led to their extinction, we do know the dinosaur’s inability to adapt and survive major shocks was a contributing factor that led to their extinction. One of the major lessons, among many, is that being large and powerful all by itself is not a guranteed formula for survival or even thriving.

The Antifragile Framework

In Nassim Taleb’s framework, things that are fragile are negatively impacted by disturbances. These disturbances include chaotic events, unpredictable shocks (Black Swans, or what I like to refer to as black pianos falling from the sky), and volatility.

Fragile objects, by definition, are easily broken during periods of chaos. Think about how a delicate vase reacts during an earthquake. The vase is easily damaged with just one violent shake. It’s irrelevant how beautiful the vase looked before the earthquake or how long it took the artisan to design the vase. The vase falls victim to the destructive forces of being fragile.

Getting back to dinosaurs, the extinction of certain creatures from nature provides ample evidence that fragility is a destructive force. Other fearsome species like the saber-toothed tiger and thylacine suffered a similar fate. For whatever reason, their fragility led to their permanent demise. From an investment perspective, the loss of capital caused by external shocks extinguishes money in a frailly built portfolio. In the context of a person’s investments, whether they be for retirement or another purpose, fragility is an acute threat to your financial well-being.

At the opposite spectrum of “fragile” are things that resist the dangerous forces of fragility. Moreover, these things go one further step – they gain from chaos. We can describe these sort of objects or things as “antifragile.”

Benefits of the Antifragile Approach

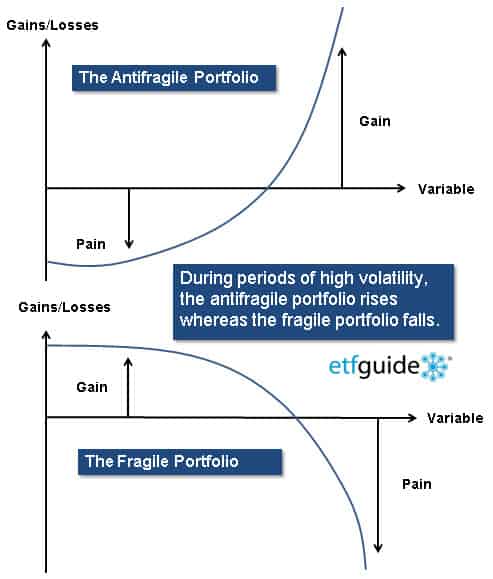

The benefits of designing an antifragile investment portfolio are only appreciated when everything seems to be going wrong. Instead of breaking during times of massive chaos, massive volatility, and a multiplicity of disorder, the antifragile portfolio actually benefits. While the fragile portfolio is vulnerable to losses, the antifragile portfolio is poised for gains. (See image above.)

Rather than describing the overall framework of how to build an antifragile portfolio, which is something I do in my online classes Build, Grow, and Protect Your Money: A Step-by-Step Guide and Profit During Crashing Markets: A Step-by-Step Guide, let’s focus on the bits and pieces of the antifragile portfolio.

It’s the components of the antifragile portfolio that allow it to gain when markets are declining. For instance, inverse ETFs, which are designed to increase in value when market prices fall, are a prime example of a component within an antifragile portfolio. Beyond stocks, inverse ETFs cover an array of asset classes including bonds, commodities, real estate, and even currencies. Inverse ETFs come in three basic iterations: unleveraged, 2x leveraged, and 3x leveraged. (Be sure to get our free inverse and leveraged ETF Guide.)

Put options are another type of antifragile object that can serve as a component within an antifragile portfolio. Instead of being damaged, put options thrive and even grow during external shocks.

Real World Application

While the philosophical roots of antifragile investing may sound complex, executing it within your own investment strategy need not be.

It’s important to remember the orientation of an antifragile portfolio is not accidental. Like a carefully engineered bridge, its existence only occurs through a series of deliberate steps that are consciously planned.

For the one-dimensional investor with a long only or buy-and-hold slant, both put options and inverse ETFs are the types of assets that benefit from large external shocks. Moreover, they provide the discerning investor with plenty of financial flexibility. Instead of liquidating an entire portfolio and incurring a large tax bill along with brokerage trading costs when financial markets go haywire, the discerning investor can simply insert antifragile components like inverse ETFs or put options to offset the inherent fragility of one-way long-only positions.

A portfolio that holds 100% of its assets in cash is not antifragile. Why? Because the only benefit provided to the investor is stability, not growth. By design, an antifragile portfolio will grow in value during turmoil and turbulence.

Think about how airplane wings react under the pressure of fierce wind turbulence. The wings absorb the air turbulence by bending and flexing. After the turbulence dissipates, the wings go back to their normal position. Did the the airplane’s wing design cause it to fly higher and faster during the air turbulence? Of course not! Rather, the airplane’s robust wing design allowed it to survive the turbulence. And therein explains the difference between a robust portfolio versus an antifragile one. A robust portfolio provides stability during stressful times, whereas the antifragile portfolio provides growth.

For a portfolio to be antifragile does not necessarily mean it needs to hold 100% of its assets in investments that benefit from disorder. Only all-or-nothing dogmatic types will tell you otherwise. This might be among the most misunderstand aspects of what the antifragile portfolio represents. Achieving antifragile status, in an investment sense, is not an all-or-nothing exercise.

Recap

Fragility is a destructive force in nature. Animal species like dinosaurs and saber-tooted tigers didn’t survive because their fragility prevented them from adapting, surviving, and thriving. Similarly, a fragile approach toward investment management can carry devastating consequences.

The orientation of an antifragile portfolio is deliberate, not accidental. Moreover, an investment portfolio does not necessarily need to be 100% allocated in antifragile assets to successfully achieve antifragile status. Unlike a robust portfolio, which merely provides stability during market turmoil, the antifragile portfolio will grow.

Antifragile assets that benefit from turmoil are:

–Put options

–Inverse ETFs

–Volatility ETFs

–Volatility call options

What type of investment portfolio do you have? Is it fragile or antifragile? Whatever the case, hopefully, it employs the type of investment approach and strategy that can thrive during any kind of market conditions, especially unfavorable ones.

If you enjoyed this article, join ETFguide PREMIUM and follow us on Twitter @ ETFguide.