In case you missed it, Wall Street’s rich and famous are having their worst yearly performance since 2011. Big bets by hedge funds on energy (NYSEARCA:XLE), healthcare (NYSEARCA:XLV), and commodities (NYSEARCA:DBC) have nuclear bombed shareholders’ money.

Here’s just a small sample of the multi-billion dollar meltdown:

• David Einhorn’s large stake in Consol Energy (NYSE:CNX), the Pittsburgh-based natural gas and coal company has gotten absolutely slaughtered. The stock has lost over 65% of its value in the past year.

• Billionaire investor Carl Icahn had ridden energy stocks straight to the bottom! Icahn has held positions in CVR Energy (CVI), Chesapeake Energy (CHK) and Transocean (RIG). Natural gas company Chesapeake has fallen 70% in the past year and offshore drilling company Transocean is down 65%.

(Audio) How to Improve the 50/50 Portfolio Mix

• Valeant Pharmaceuticals (NYSE:VRX) is a widely held stock by some of the most highly esteemed fund managers on the planet like John Paulson, Bill Ackman, Ken Griffin, and Jeremy Grantham. VRX has lost 65% over the past three-months alone!

For individual investors that decide to invest in hedge funds, where is the proper location for these types of investments?

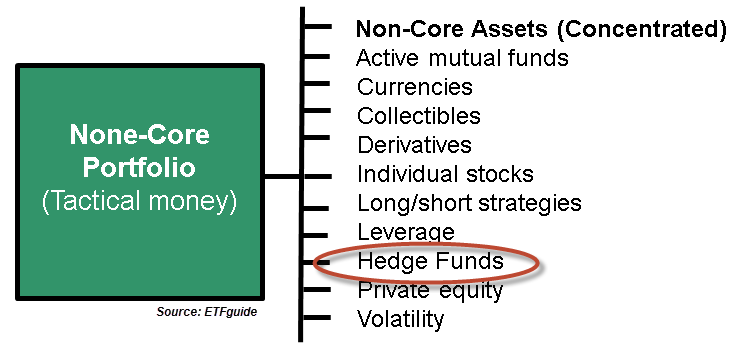

It’s an important question that deserves a logical response and the diagram below illustrates the answer. As you can observe, the proper and only place for hedge funds is inside a person’s non-core investment portfolio.

Naturally, a person’s non-core portfolio will exclusively own tactically oriented non-core assets like actively managed funds, currencies (NYSEARCA:UUP), individual stocks, and hedge funds, among other non-core investments. Furthermore, a person’s non-core portfolio is always smaller in size compared to a person’s core portfolio. Why? Because like a structurally sound building, an architecturally strong investment portfolio, can never have a foundation or core that’s smaller than what’s above it. As a result, the core portfolio should represent the bulk of a person’s net worth, whereas the non-core is smaller and complimentary to the person’s core portfolio.

Investors who mis-allocate money into hedge funds (NYSEARCA:QAI) for their “core” portfolio are making a grave fundamental mistake. Not only do they expose themselves to higher volatility and elevated fees, but they put themselves at risk for the possibility of large losses. (The individuals who lost all of their money in Bernard Madoff’s Scheme are an excellent case study of this flawed investment approach, despite being an extreme example.)

Finally, putting hedge fund money where it doesn’t belong (inside a core portfolio instead of the non-core portfolio) is akin to wearing your finest beach attire smack dab in the middle of a frigid and icicle filled winter. It may look really cool in your Instagram pictures, but frost bite doesn’t lie.

Ron DeLegge is the Founder @ ETFguide and Inventor of the Portfolio Report Card grading system that has been used to analyze and grade over $100 million in investment portfolios. Find out if your investment portfolio passes or fails.