What do you get when you add up Twitter, Yelp, and Weibo? Answer: Deflation. That’s the latest joke as former high-flying tech stocks fizzle, while Treasury bonds sizzle.

Over the past several weeks we’ve seen a major shift in the market’s psychology away from risky equity bets. And as these high risk/high beta equity segments get clobbered, bond prices continue to rise.

The May 2014 issue of the ETF Profit Strategy Newsletter noted:

“In the small-cap arena, around 40% of stocks in the iShares Small Cap Russell 2000 (NYSEARCA:IWM) are down 20% or more from their 52-week high. In previous market cycles, hot performers were typically the last ones to be taken out, following the rest of the stock market lower. In this cycle, it appears the hot performers have been the first ones to be dragged down. It’s an obvious red flag.”

Is the punishing in tech (NYSEARCA:FDN) and social media (NYSEARCA:SOCL) stocks a prelude for trouble ahead in the broader stock market?

AUDIO: Listen to Ron DeLegge @ The Index Investing Show

Only two times during the past 35-years has the NYSE Composite Index (NYSEARCA:NYC) been at all-time highs while the Russell 2000 small cap index simultaneously cut below its 200-day moving average. “Those two times were in 1999 and 2007,” observes Chris Kimble, proprietor at Kimble Charting Solutions. “Now it’s occurring for the third time in three decades.” Will this time be different?

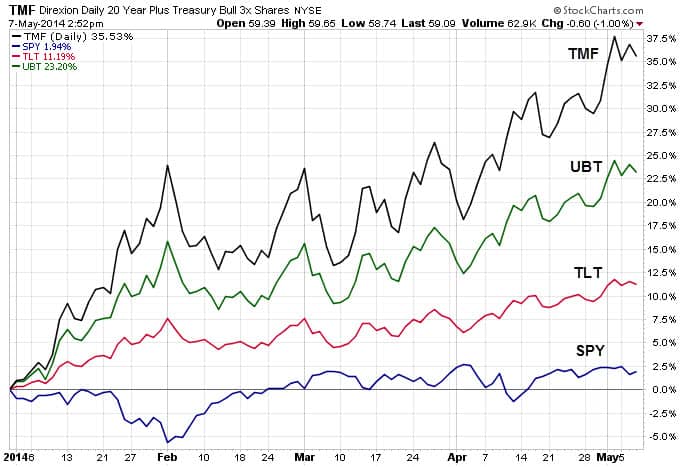

Meanwhile, the narrative of outperformance by Treasury bonds over U.S. stocks (NYSEARCA:IVV) continues to play out.

The chart above shows that daily 2x (NYSEARCA:UBT) and 3x leveraged long-term Treasury bond funds (NYSEARCA:TMF) have smoked the S&P 500 with YTD gains from 23% to 35%. The unleveraged iShares 20+ Yr Treasury Bond Fund (NYSEARCA:TLT) has gained over 11% while the S&P is up around 2%.

The ETF Profit Strategy Newsletter uses technical and fundamental analysis along with market history and common sense to keep investors on the right side of the market. We cover gold along with other major asset classes like stocks, bonds, and currencies. In 2013, 70% of our weekly ETF picks were winners.

Follow us on Twittter @ ETFguide