Stock market volatility is frequently portrayed as an evil force that all investors should strive to avoid. However, embracing volatility (ChicagoOptions:^VIX) rather than avoiding it can be extremely lucrative.

On 12/17/14 we told our subscribers the following via our Weekly ETF Picks:

“The VIX has been on a tear, gaining almost 40% since early December. Here’s what’s particularly notable about that move: the S&P 500 (NYSEARCA:SPY) was down only -1.26% over that same time frame! If VIX can soar almost +40% on a -1.25% loss, what type of potential does it have for a sharper pullback? We’re buying the ProShares VIX Short-term Futures ETF (NYSEARCA:VIXY) at around $20 and our tandem options trade (for more leverage) is to buy VIX Feb 2015 17 call options (VIX150218C00017000) at around $275 per contract. Bottom line: More than just bracing for higher stock market volatility, we want to profit from this theme.”

(Audio) Ron Analyzes and Grades a $2 Million Investment Portfolio that Costs Way Too Much

On the same day as our 12/17 alert, via our Technical Forecast we confirmed this view of rising volatility by saying:

“The longer term uptrend in risk remains. The VIX is still above the 16 level and options traders are not buying this rally (in stocks) as volatility remains elevated.”

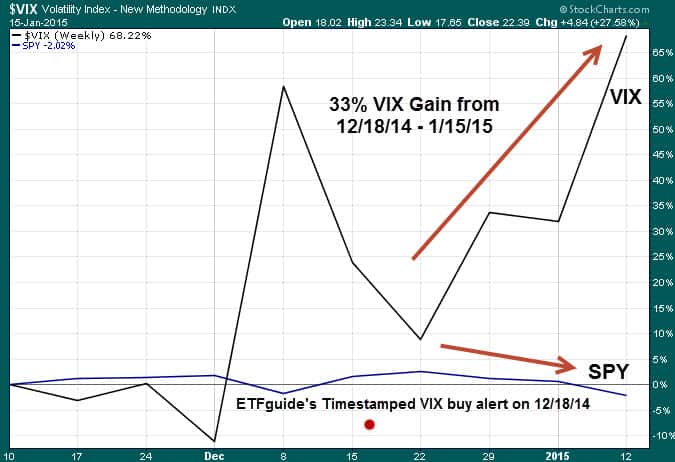

The chart below illustrates how the VIX soared +33% right after our volatility buy alert. In the end, we bagged a +46% timestamped gain on the February call options trade in a 4-week turnaround.

Although ETFs that attempt to mute volatility (NYSEARCA:SPLV) have become popular choices over the past few years, embracing volatility rather than avoiding can provide far more than just good results. You also get returns that have a low correlation with the rest of your portfolio.

Follow us on Twitter @ ETFguide