Welcome to October, the most historically volatile month of the year!

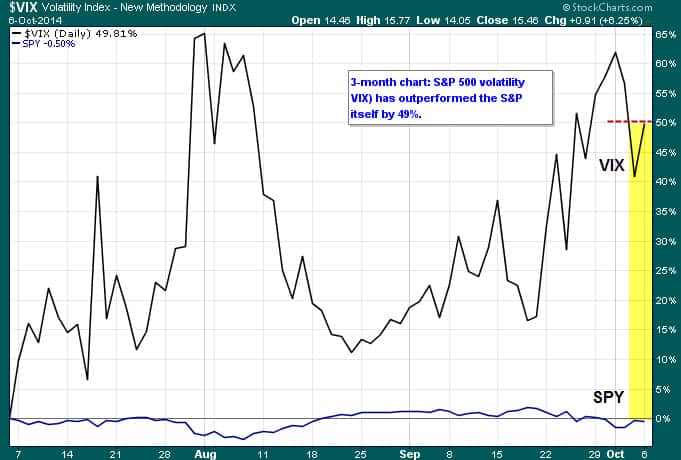

The good news for bulls is that the S&P 500 (SNP:^GSPC) still trades above key support levels and remains in an uptrend. Yet, stock market volatility – which typically decreases when stocks are up – has gained even more. (See our 3-month chart below) You can add this sort of weirdness to the long and growing list of market dislocations.

High stock market volatility (NYSEARCA:VXX) is usually associated with bear markets. And while the Internet is cluttered with fantastic bear predictions of every size and color, stock prices (NasdaqGM:QQQ) haven’t yet confirmed a full-fledged bear. At best, what’s happening in the VIX is a warning sign.

(AUDIO) Listen to Ron DeLegge @ The Index Investing Show

Yes, talking about higher stock market volatility (ChicagoOptions:^VIX) is fun, but profiting from it is better.

Just as the latest volatility wave was getting started, we alerted our readers on July 9 via our Weekly ETF Picks by saying the following:

“While most market participants are expecting a lack of stock market volatility to be a sustainable trend – we’re betting the opposite. We’re buying the VIX (strike price and expiration reserved for subscribers) call options at around $200 per contract. Never count the VIX out – especially when the stock market’s overall mood is still this unworried and complacent. When another short-term pop in the VIX arrives fast and furious, we’ll be ready.”

As the chart shown above clearly illustrates, since early July (when our alert was issued), the VIX has soared 49% while the S&P 500 (NYSEARCA:IVV) is down 0.50%.

What’s remarkable about the VIX’s three-month surge is that it’s happened while stocks have delivered flat performance. How do you think the VIX (NYSEARCA:UVXY) is going to react when a deeper and sustainable pullback in the stock market (NYSEARCA:DIA) finally occurs?

October is just getting started and we’ve already bagged a 23% timestamped gain on our Oct. VIX trade. That position has since been closed and was replaced with another VIX ETF trade which is now up 20% and still open.

The best way not to get blindsided by higher volatility is to be ready for it before it happens.

The ETF Profit Strategy Newsletter uses technical analysis, market history and common sense to keep investors on the right side of the market. We cover all major asset classes including stocks, bonds, currencies, real estate, and commodities. Our largest year-to-date winner is a +188% timestamped gain from our Jun. 5 Weekly Picks. All readers get email and text alerts too.

Follow us on Twitter @ ETFguide