Diversifying your investment portfolio: It’s a dull exercise that people repeatedly hear, yet a chore they execute with consistent imprecision. Are there times when diversification can actually become “Di-Worsification”?

Variety is the Secret

Diversification boils down to spreading your investment risk across multiple asset classes. It works because of something called “covariance,” which basically means that assets aren’t always perfectly correlated with each other. Let’s examine a quick example.

AUDIO: Listen to Ron DeLegge @ The Index Investing Show

Commodities, (NYSEARCA:GCC) in one type of market environment, might rise whereas emerging market stocks (NYSEARCA:VWO) simultaneously fall. In different market conditions, the opposite extreme may occur and emerging markets may actually rise whereas commodities fall. What’s the overall effect of owning both commodities and emerging markets together in the same diversified investment portfolio? The portfolio’s investment returns are smoothed out. In other words, the poor performance of one asset is offset by the good performance of another to produce a desirable result.

Owning Lots of the Same Stuff

Via my Portfolio Report Card service, I recently graded a $725,000 investment portfolio that held two mutual funds, two ETFs, and 16 individual stocks. The owner was convinced that his investments were fully diversified because two of the funds – the Nasdaq-100 ETF (NasdaqGM:QQQ) and the Technology Sector SPDR ETF (NYSEARCA:XLK) – each hold a basket of different stocks.

The problem is that QQQ and XLK are highly correlated (0.97 over the past decade) in both performance and risk since both ETFs own many of the same technology stocks. Additionally, the 16 stocks held in the $725,000 account were more of the same; technology focused companies.

How can a portfolio with lots of stocks still not be adequately diversified?

Remember: Being properly diversified isn’t about owning the highest number or highest quantity of stocks, ETFs, or mutual funds, but rather owning assets that are different or uncorrelated from each other.

Avoid Drifting Mutual Funds

Style drift is a major problem facing investors who buy actively managed mutual funds. This is my second example of when diversification becomes “di-worsification.”

The Fidelity New Millennium fund (Nasdaq:FMILX), for instance, is categorized as a U.S. stock fund, yet 10% of the fund is invested in international stocks. When besides never does it make sense to buy a domestic stock fund to obtain international equity exposure? In fairness, FMILX is not the only mutual fund labeled “domestic equity” that invests in foreign securities.

For investors, mutual funds that style drift undermine both diversification and asset allocation. Think about it this way: If a person buys 5 mutual funds that each have 10-15% of their fund portfolios invested in places where the investor doesn’t know or expect, the risk profile of the overall portfolio holding these 5 mutual funds is radically altered for the worse.

On a positive note for people who build their portfolios with ETFs, you will never find an index ETF that is labeled “U.S. stocks” (NYSEARCA:SCHB) investing in foreign securities (NYSEARCA:EFA) or vice versa.

Summary

Investment portfolios that lack diversification are consistently more volatile and risky than the market. Furthermore, the actual risk of undiversified portfolios frequently exceeds the risk capacity of the owners. If these hidden risks aren’t pre-identified and corrected via my Portfolio Report Card or some other mechanism, investors usually learn about them after they’ve been clobbered with deep losses. (See the 60-100% losses experienced by investors that overweighted their portfolios in bank/financial stocks during the 2008-09 periods.)

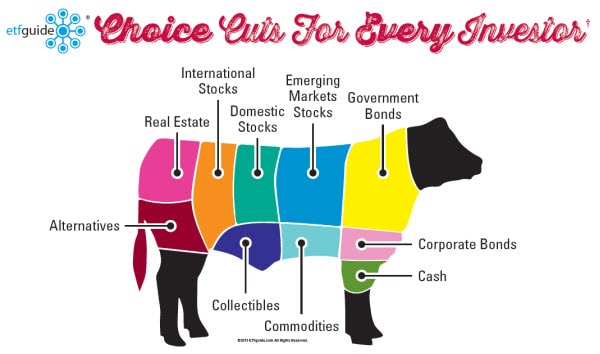

To help people grasp the meaning of true diversification, I like to illustrate it as the various beef cuts of cattle. (See above) Each distinct part of the cow isn’t necessarily better, but works together in unison.

Diversification won’t prevent market losses. But properly executed, it should limit risk and reduce your portfolio’s volatility.

What’s wrong with your investment portfolio? Ron DeLegge’s Portfolio Report Card will tell you. And if your portfolio is smart enough to score an “A,” you’ll get $100. It’s Ron’s way of rewarding well-built investment portfolios.

Follow us on Twitter @ ETFguide