What’s Inside Direxion’s Daily Semiconductor Bull and Bear 3x shares?

The Direxion Daily Semiconductor Bull (SOXL) and Bear 3X Shares (SOXS) seek daily investment results, before fees and expenses, of 300%, or 300% of the

The Direxion Daily Semiconductor Bull (SOXL) and Bear 3X Shares (SOXS) seek daily investment results, before fees and expenses, of 300%, or 300% of the

In this Season 5 episode of ETF Battles, Ron DeLegge @etfguide referees a cryptocurrency showdown between the Grayscale Ethereum Trust (ETHE), Grayscale Digital Large Cap

USCF Gold Strategy Plus Income Fund (Ticker: USG) Overview Investment Strategy The Fund seeks to achieve its investment objective by maintaining substantial economic exposure to

In this season 4 episode of First Look ETF, Stephanie Stanton @etfguide analyzes recently launched ETFs from Allianz Investment Management, DoubleLine and Federated Hermes. The

Softs are an often overlooked and misunderstood part of the commodities market. This group includes commodities like cocoa, cotton, coffee and sugar. Why should investors

In this Season 5 episode of ETF Battles, Ron DeLegge @etfguide referees an technology and semiconductor equity ETF showdown between Invesco (QQQ), State Street Global

In this episode of Spotlight, Stephanie Stanton @etfguide speaks with Lance McGray, Head of ETFs at Advisors Asset Management about the tug-of-war between growth and

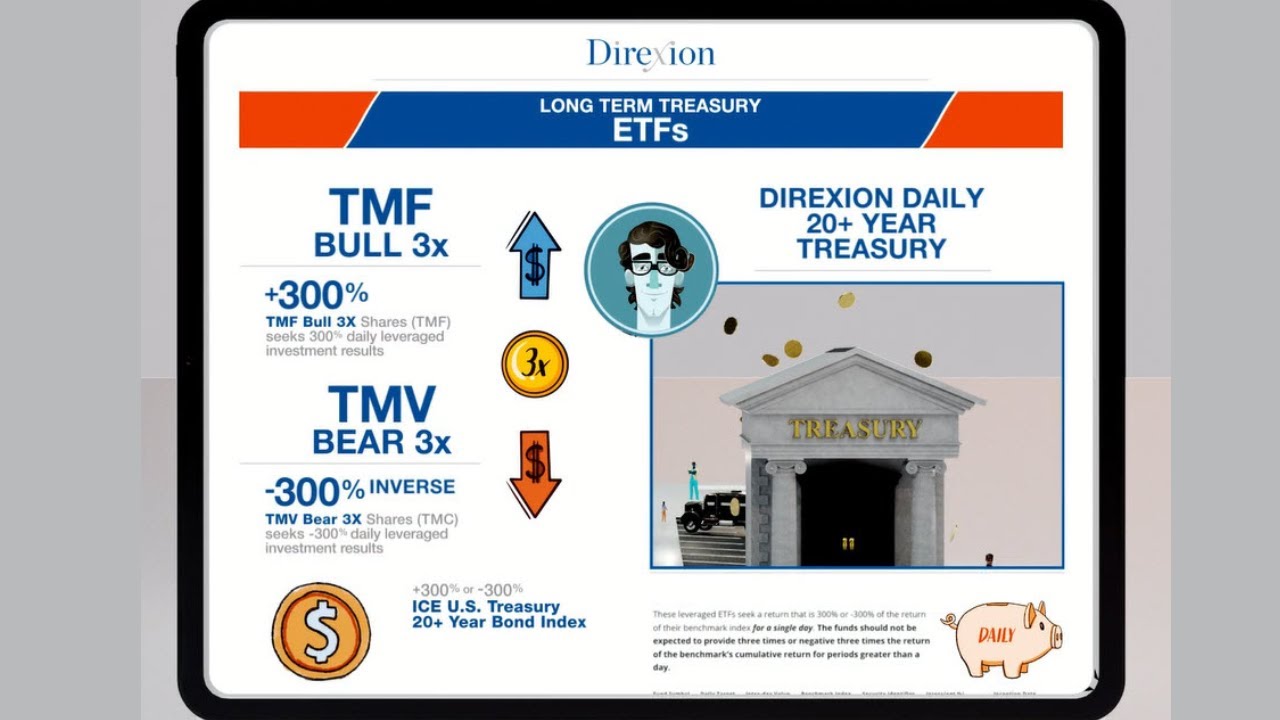

The Direxion Daily 20+ Year Treasury Bull & Bear 3X Shares seek daily investment results, before fees and expenses, of 300%, or 300% of the

In this debut episode of Shifting Energy (Season 1), Thalia Hayden @etfguide talks with John Ciampaglia, the CEO at Sprott Asset Management about the resurgence

The Direxion Daily S&P 500 Bear 1X Shares (SPDN) seeks daily investment results, before fees and expenses, of 100% of the inverse (or opposite) of

In this episode of Spotlight, Thalia Hayden @etfguide speaks with with John Love, CFA and CEO at USCF Investments. We discuss the role of commodities

The Direxion Daily Technology Bull (TECL) and Bear (TECS) 3X Shares seek daily investment results, before fees and expenses, of 300%, or 300% of the

In this episode, Ron DeLegge @etfguide tells you about top ETFs linked to the S&P 500, Nasdaq, industry sectors, Bitcoin and single stocks like Meta

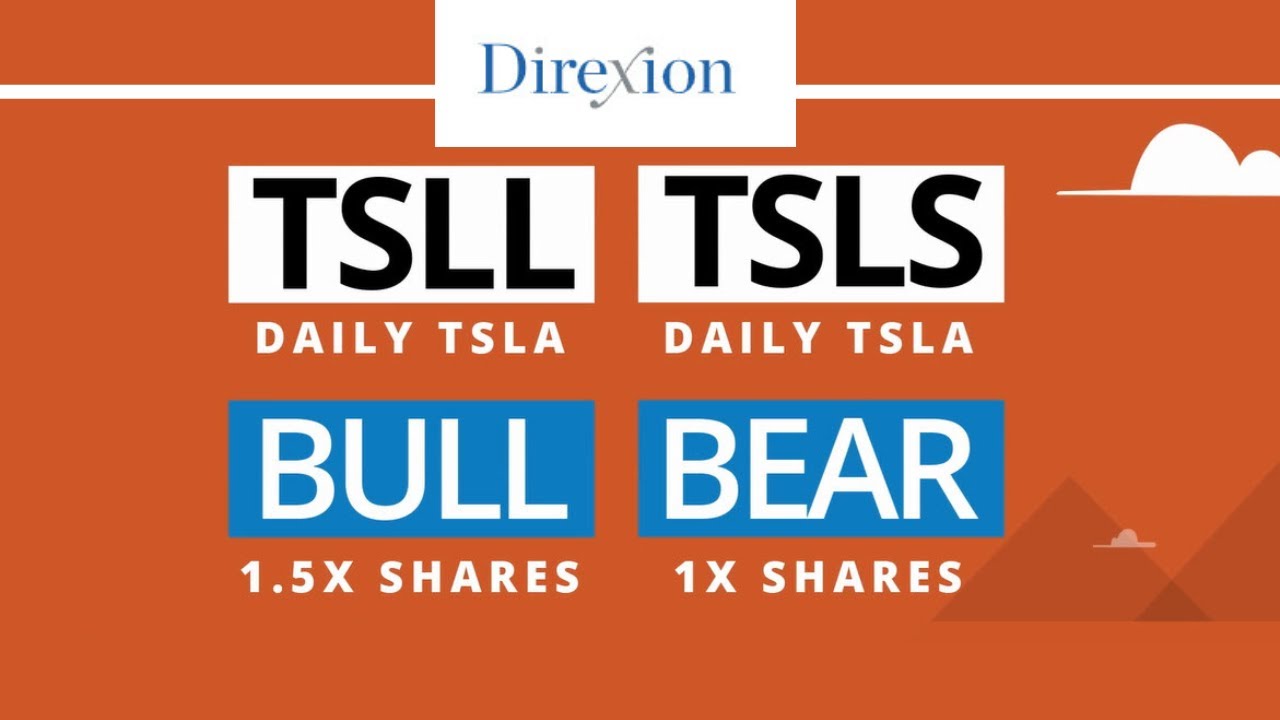

The Direxion Daily TSLA Bull 1.5X Shares and Direxion Daily TSLA Bear 1X Shares seek daily investment results, before fees and expenses, of 150% and

In this season 4 episode of First Look ETF, Stephanie Stanton @etfguide analyzes recently launched ETFs from F/m Investments, Neuberger Berman and Range ETFs. The

In this episode of Spotlight, Thalia Hayden @etfguide speaks with Paul Baiocchi, CFA & Chief ETF Strategist at SS&C ALPS Advisors. Topics covered include ETF

In this Season 5 episode of ETF Battles, Ron DeLegge @etfguide referees an audience requested matchup between active investing dividend strategies from the Capital Group

In this Season 5 episode of ETF Battles, Ron DeLegge @etfguide referees an audience requested quadruple header contest between global stock ETFs from BlackRock (IOO)

In this season 4 start of First Look ETF, Stephanie Stanton @etfguide analyzes recently launched ETFs from John Hancock Investment Management, Sofi and Texas Capital

In this Season 5 episode of ETF Battles, Ron DeLegge @etfguide referees an audience requested quadruple header contest between small cap value ETFs from Dimensional