“If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring,” observed George Soros. Which sector of the stock market fits that description?

“Boring” is the one adjective that aptly describes the ho-hum utilities (NYSEARCA:XLU) sector. This particular segment of the stock market has been long associated with orphans and widows who have little appetite for risk and a big need for steady dividend income.

(Audio) Listen to Ron DeLegge @ The Index Investing Show

Utilities generate revenue by producing, distributing, and transmitting electricity and natural gas. The S&P Utilities sector consits of 30 stocks including companies like Duke Energy (NYSE:DUK), Exelon (NYSE:EXC), Southern Co. (NYSE:SO), and Dominion Resources (NYSE:D).

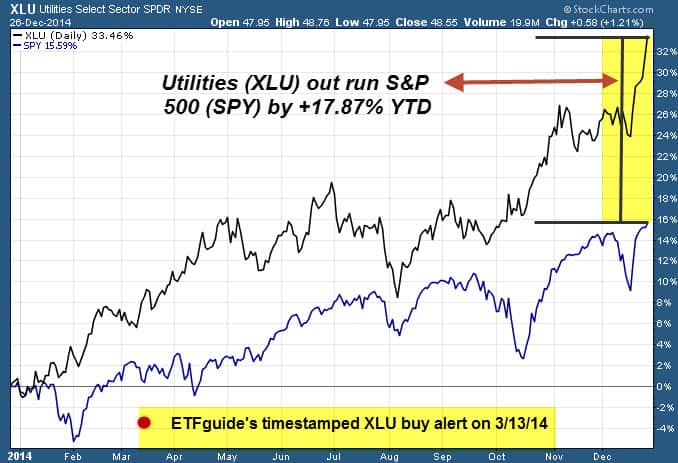

Before utilities really started to surge, our Weekly ETF Picks from 3/12/14 highlighted a big opportunity in this ever dull sector. We wrote to readers:

“If one must invest in equities, doing it via steady, dividend payers that are defensive is smart. And the Utilities SPDR ETF (XLU) fits the bill. The fund carries a dividend yield (3.77%) almost double the S&P 500’s depressed 1.87% yield. If interest rates stay contained, the fund has potential to add to its 6% YTD gain. We’re buying XLU.”

Not only have boring utility stocks outperformed sexier sectors like technology (NYSEARCA:XLK) and healthcare (NYSEARCA:XLU), but they’ve crushed these sectors on a total return basis when factoring in dividend payments. Utilities have also outperformed the broader U.S. stock market (NYSEARCA:SCHB).

Owning utilities at a time when stock market valuations are stretched proves one more thing: It’s far better to buy a wonderful industry sector at a fair price than a fair industry sector at a wonderful price.

Follow us on Twitter @ ETFguide