ETFs seduce people to become daytraders! That’s the populist claim lodged against ETF investing, but is it supported by facts? What does the data show?

To find out, a Vanguard study titled “ETFs: For the Better or Bettor?” examined more than 3.2 million transactions in more than 500,000 positions held in the mutual fund and ETF share classes of four different Vanguard funds from 2007 through 2011.

Unlike other ETF providers which only offer ETF shares, Vanguard’s ETFs are an additional share class within the mutual fund structure. For example, the Vanguard Total Stock Market ETF (NYSEARCA:VTI) has an identical portfolio as the Vanguard Total Stock Market Index Fund (Nasdaq:VTSMX).

By obtaining information from the transaction and account records of actual Vanguard clients, the company was able to get to the bottom of line truth of how investors are really using ETFs.

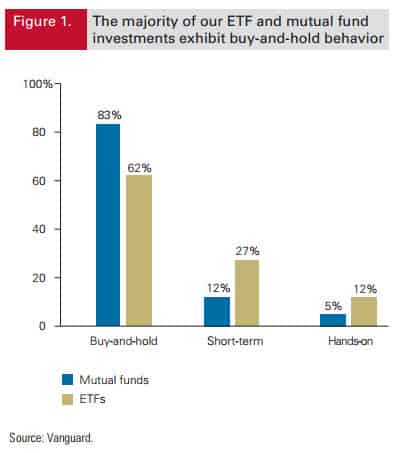

As shown in Figure 1, the majority of both traditional mutual fund (Nasdaq:VFINX) and ETF investments (NYSEARCA:VDE) in Vanguard’s study were categorized as buy-and-hold investments (83% and 62%, respectively). This contradicts the allegations made that ETFs are nothing more than short-term trading vehicles used to speculate. “We found little evidence of speculative behavior in either share structure,” said the Vanguard report.

(Audio) Listen to Ron DeLegge @ The Index Investing Show

One final data point dealt with investment reversals or a change in investment direction (the first buy after selling or the first sell after buying) by Vanguard’s ETF investors (NYSEARCA:VNQ).

The study’s results showed that 99% of traditional mutual fund investments and 95% of ETF investments did not exceed a rate of four reversals per year. Furthermore, less than 1% of ETF positions averaged more than one investment reversal per month. That’s not exactly the sign of daytrading activity!

Vanguard summarized its findings saying:

“Although behavior in ETFs was more active than behavior in traditional mutual funds in the Vanguard positions we studied, more than 40% of the variation can be explained simply by correcting for differences in personal and account characteristics between ETF and traditional fund shareholders. We conclude that it is not valid to assume that the so-called ETF temptation effect explains the higher-observed trading in ETFs relative to mutual funds, nor is it a reason for long-term individual investors to avoid using appropriate ETF investments as part of a diversified investment portfolio.”

Although this study was limited to Vanguard shareholders, it doesn’t diminish facts: ETFs are being used as long-term investments.

Follow us on Twitter @ ETFguide