The framework for an architecturally sound investment plan is to have a core portfolio built upon core asset classes. Like the foundation of a building, your portfolio’s core must be built on a solid and stable footing. While there are many things within your investment plan that are optional, this isn’t one of them. Before answering the question of what pieces are missing from your current investment plan, we must first answer this question: What are core asset classes?

(Podcast) Summer Cooking Lessons + Sector Investing Wrap

In his book Unconventional Success: A Fundamental Approach to Personal Investment (2005), legendary investor, David F. Swensen the Chief Investment Officer at Yale University, outlined three hallmarks of what defines and separates core asset classes from other investments.

1) Core asset classes must contribute “basic, valuable, differentiable characteristics to an investment portfolio.

2) Core asset classes must rely “fundamentally on market-generated returns, not on active management of portfolios.”

3) Core asset classes must be derived from “broad, deep, and investable markets.”

Although Swensen rightly classifies stocks, bonds, and real estate as core asset classes, he completely ignores commodities. Why? One reason might be because when Swensen’s book was first published 11 years ago, commodities weren’t as much of an “investable market” as they are today. What’s changed?

Thanks to growth in the burgeoning exchange-traded fund (ETF) marketplace, commodities have been securitized, finally making them an “investable market” for the average investor. In other words, with a brokerage account, you can now own a piece of the multi-trillion dollar commodities market by simply investing in exchange-traded products linked to the performance of commodities. Long gone are the days of needing to open a futures brokerage account or buying a farm to get commodities exposure.

Wall Street’s perpetual bias against investing in commodities doesn’t change the fact that commodities are still a core asset class. Unfortunately, Wall Street doesn’t get it and probably never will. Yet, commodities clearly meet Swensen’s strict criterion for what defines a core asset class. Moreover, commodities are a global multi-trillion dollar marketplace that have existed since the beginning of time, and long before the invention of stocks and bonds. Although commodities don’t generate any earnings, dividends, or interest, they add a crucial dimension of portfolio diversification that cannot be obtained with a portfolio that exclusively holds stocks, bonds, or real estate.

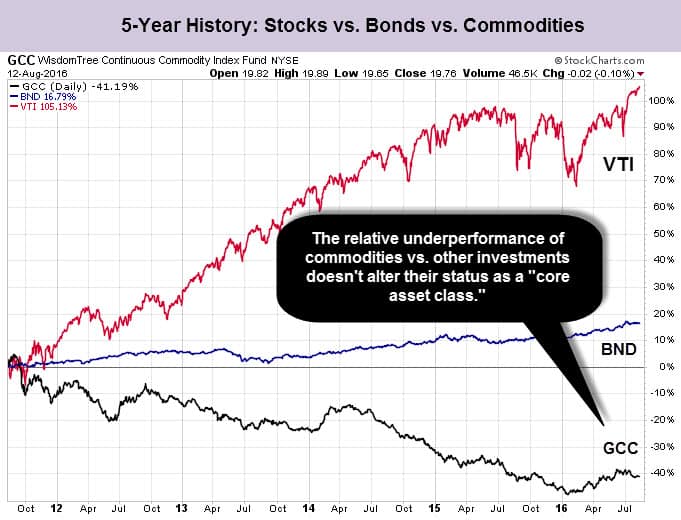

Since the early 1990s, commodities have drastically underperformed relative to other core asset classes and the five-year chart shown above partially illustrates this.

As you can see, the WisdomTree Continuous Commodity Index Fund (NYSEARCA:GCC) has substantially lagged the performance of the Vanguard Total U.S. Stock Market ETF (NYSEARCA: VTI) along with the Vanguard Total U.S. Bond Market ETF (NYSEARCA:BND). Bad as that may seem, please don’t misinterpret the data.

Regardless of the substantial historical underperformance that commodities have suffered as of late, they are 1) still a core asset class, and 2) offer substantial hedging benefits to a securities portfolio.

Obtaining diversified exposure inside your core portfolio is imperative. In other words, having market exposure to just one sector of the commodities market like gold (NYSEARCA:GLD), silver (NYSEARCA:SLV), or oil (NYSEARCA:USO) does not provide an adequate proxy of performance or diversification for the entire commodities market. To do this, you need to own an ETP or ETF that constantly holds a broad collection of different commodities including agriculture, energy, and metals. This is what you learn in ETFguide’s online courses which are exclusively available to premium ETFguide members.

In summary, if there’s one piece of the core asset class universe that you lack, it’s probably commodities.