How many people sold their stocks at the 2009 bottom, went to cash and then bought gold at its 2011 peak?

In my latest Index Investing Show podcast episode, I explain how “double whammy” effect has damaged certain investment portfolios so severely, the losses could be catastrophic.

The solution for investors sitting on big losses from precious metals (NYSEARCA:GLTR) is to rehabilitate and reconstruct their portfolios. For example, using precious metals (NYSEARCA:SLV) as your portfolio’s “margin of safety” money is a fundamental flaw. Why? Because gold (NYSEARCA:GLD), like stocks and bonds, can lose market value. Remember: Insurance coverage should never lose value.

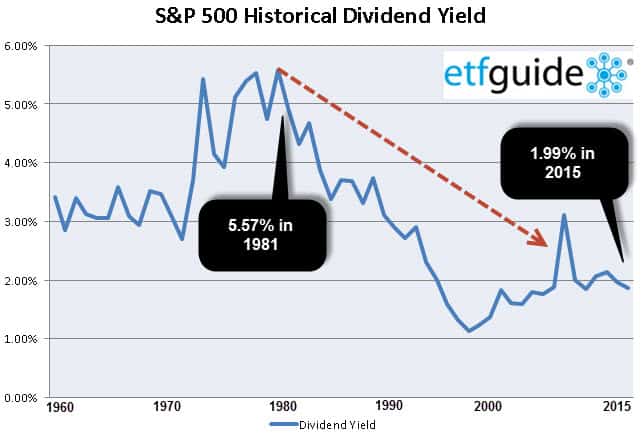

Although U.S. stocks (NYSEARCA:SCHB) are still hanging on to their year-to-date (YTD) gains, dividend yields are still depressed.

The chart below shows how the S&P 500’s (SNP:^GSPC) dividend yield has collapsed 64% since 1981 from 5.57% to a current yield of 1.99%. As a result, many investors have chased higher yielding assets like long-term U.S. Treasuries (NYSEARCA:TLT) and junk bonds (NYSEARCA:HYG) in search of more income. And if they don’t get snake-bitten by rising rates, rising defaults on low rated debt could unexpectedly catch many people completely off guard.

In this same episode, I talk about the covered call income strategy and I provide a real-time update on the August income trade for the ETF Income Mix Portfolio. Since Feb. 2012, this all-ETF portfolio offer to ETFguide’s premium subscribers has averaged monthly income of $842. There is no one single perfect income strategy, but selling covered calls offers a consistent form of cash flow beyond dividends from stocks and income payments from bonds (NYSEARCA:BOND).

One final feature of the podcast is a Portfolio Report Card diagnosis I execute on a $565,000 account for BA in Michigan. BA is a married couple in their 50s that submitted their portfolio for examination because they’re concerned about the performance of their investments. Does their portfolio pass or flunk? Listen to find out.

Follow us on Twitter @ ETFguide