Some of us got started late at saving and investing for retirement. And while the financial services industry enjoys browbeating people who lack discipline, got distracted or got into trouble and temporarily paused saving money, I think empathy is due when empathy is warranted.

This week’s Portfolio Report Card is for K.E., a 60-year old who warrants empathy. She works in a medical office and she ran into a rough patch with her retirement plan. Her husband battled unemployment during the 2008-09 recession and she put three kids through college. Although this slowed down the velocity of K.E.’s ability to save for retirement, she didn’t quit and she kept going.

(Audio) Does this 26 mutual fund $405,000 portfolio pass or fail?

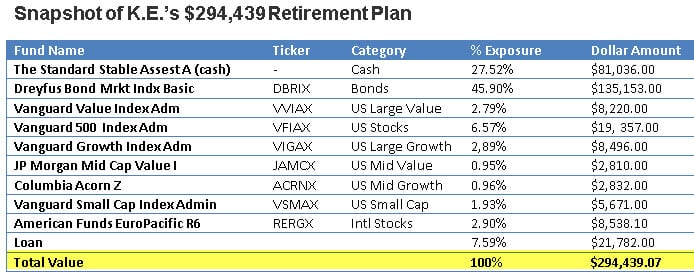

K.E. asked me to analyze and grade her 401(k) plan valued at $294,439. She owns 9 mutual funds and she told me that “I have seen my retirement fund cut basically in half twice over the years due to downturns in the market. I don’t trust the government and frankly I don’t trust financial advisors either! So I rely on the portfolios offered by our retirement plan. I feel like it’s all one big crap shoot either way I go.”

What kind of grade does K.E.’s portfolio get? Let’s find out.

Cost

Reducing investment cost is easily accomplished by investing in low cost vehicles and making an concerted effort to eliminate trading activity.

The mutual funds held in K.E.’s 401(k) plan charge 0.05% on the low end and 1.25 % on the high end. Nevertheless, she has smartly positioned most of her assets in the lower cost index funds, which has kept a lid on cost. Her asset weighted expense ratio is 0.37%.

Diversification

The whole point of diversifying your investments is to spread financial risk across a variety of different asset classes versus putting all of your money into one thing.

K.E.’s portfolio has exposure to U.S. stocks (Nasdaq:VFIAX), (Nasdaq:VVIAX), (Nasdaq:VIGAX), International stocks (Nasdaq:RERGX), bonds (Nasdaq:DBIRX), and cash (Stable value fund). Outstanding! However, her portfolio is deficient in this grading category because she lacks exposure to two major asset classes: commodities (NYSEARCA:GSG) and real estate. Remember: Authentic portfolio diversification never excludes major asset classes.

Risk

K.E. described herself as a very conservative investor who was burned in the past. Gun shy and slightly scared might be another description.

The overall asset mix of K.E.’s 401(k) plan is the following: 46% bonds, 27% stocks and 27% cash. And if there’s one possible error with this asset mix, it’s that it’s too conservative. However, K.E. is a risk adverse 60-year old person and she told me that she can’t stomach a significant hit when the next market correction happens.

Tax Efficiency

All well-built investment portfolios deliberately minimize the threat of taxes. This includes tax-deferred retirement plans like IRAs and 401(k) plans where tax-efficiency is often incorrectly presumed.

Currently, K.E. has $21,782 outstanding 401(k) loan. If she leaves her job without paying off the loan it will become taxable income. So long as the loan remains, it hangs over her as a constant threat of unwanted taxable income. Undermining the tax-efficiency of a tax-deferred plan is never a good idea!

Performance

Investment portfolios that ignore the first four grading categories – cost, diversification, risk, and tax-efficiency – generally have performance problems. How did K.E. do?

K.E.’s portfolio grew 7.4% from December 2013 to December 2014 compared to a +8.3% gain for our blended index benchmark matching this same asset mix. Although her one-year performance was slightly less than the benchmark, it’s satisfactory.

The Final Grade

K.E.’s final grade is B (excellent). The tax-efficiency of her retirement portfolio scored the poorest, whereas cost and performance were the best grading categories.

Although equity bulls (NYSEARCA:IVV) will no doubt criticize her asset mix for being ultra-conservative, she’s clearly defensive and cannot afford to suffer a major setback. She also fully understands that she will probably have to work part-time and string together income from social security and her current portfolio to survive.

Although K.E. got sidetracked with saving for her retirement, let’s hope she continues without letup from this point forward. Her plan is to retire from full-time work in just six more years, so there’s no wiggle room for major mistakes.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.