How can a person tell the difference between a healthy and unhealthy investment portfolio? Naturally, it’s by how well (or poorly) a portfolio does at addressing crucial areas like taxes, cost, diversification, risk, and performance. Here’s the problem: Poorly constructed portfolios are usually ignorant about these first four things, which explain why unsatisfactory performance results follow.

My latest Portfolio Report Card is for PLR in Medley, FL. This vibrant married couple is in their early 60s, he’s still working and she’s retired.

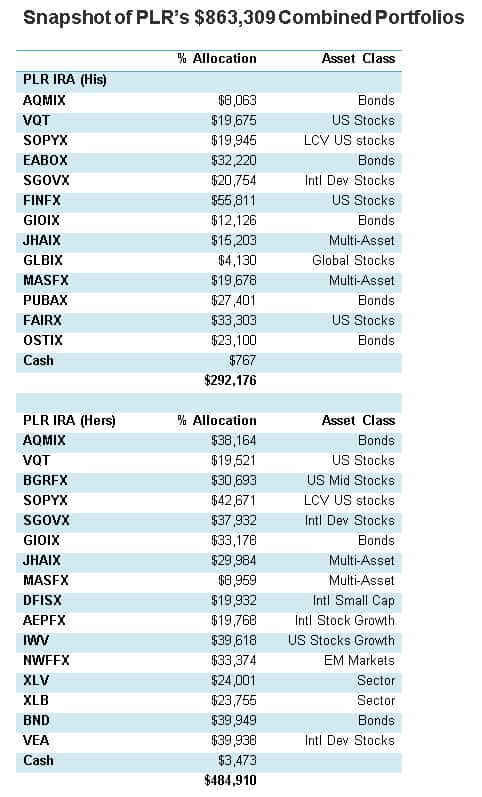

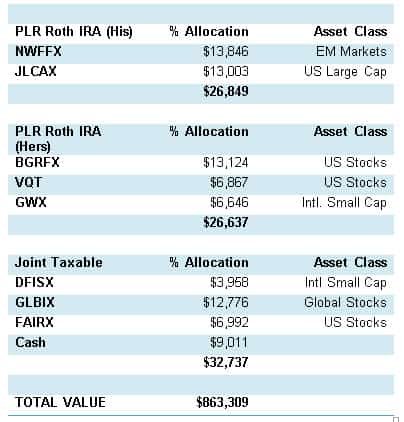

PLR has a financial advisor but recently became concerned about the cost and investment choices within their portfolio. PLR asked me to analyze and grade their combined portfolios to identify strengths and weakness of their $863,309 investment plan.

(AUDIO) Portfolio Talk: A $2 Million Investment Account with Out of Control Cost

After a brief initial chat, PLR told me they are still in the accumulation phase of their investment plan and they intend to hold off on taking retirement distributions and accessing Social Security until they reach full retirement age. “We want to protect what we have accumulated and only pull 3.0 % (real return) out of our portfolio every year, starting in 2018,” they told me.

PLR’s combined portfolios consist of two traditional IRAs, two Roth IRAs, and a joint taxable account. PLR owns 17 mutual funds and 7 ETFs.

It’s worth mentioning that PLR told me they expect to receive a very poor Portfolio Report Card grade of “D” or “F.” Will they be able to beat their own depressed expectations?

Let’s do a Portfolio Report Card and find out.

Cost

A portfolio with excessive investment cost doesn’t need a bad year to underperform and that’s why minimizing investment cost to the greatest degree possible is tantamount. This means cutting fund expenses, brokerage commissions, and other frictional costs.

The average expense ratio for PLR’s mutual fund and ETF holdings is 0.91%. And if we add another 1% for the annual advisor fee they’re paying, total expenses approach 2% annually.

Although PLR owns a few low cost ETFs like the iShares Barclays Aggregate Bond Fund (NYSEARCA:BND), iShares Russell 3000 (NYSEARCA:IWV), Healthcare SPDR (NYSEARCA:XLV), Materials SPDR (NYSEARCA:XLB), the bulk of their money are in higher cost funds.

Diversification

Authentic diversification is all about exposure to all the major asset classes including stocks, bonds, commodities, real estate, and cash.

PLR’s combined IRAs and taxable account has exposure to U.S. (Nasdaq:BGRFX) and foreign stocks (Nasdaq:SGOVX), bonds (Nasdaq:EABOX), and cash. This is excellent!

However, the combined portfolios miss major asset classes including global real estate, international bonds, and commodities. Also, some of the multi-asset class funds (See JHAIX and MASFX) held in these portfolios hold a mix of stocks along with bonds and complicate the process of precise asset allocation because managers can increase or decrease their market exposure to whatever asset classes they want at will.

Finally, I discovered a real dearth of core fund holdings in PLR’s portfolio that rightly could be classified as broadly diversified proxies of the asset classes they track.

Risk

The risk character of a portfolio should always be 100% compatible with the risk profile of the person(s).

PLR told me they are neither aggressive nor conservative investors but somewhere in the middle (moderate). And PLR’s IRA (hers) holds 68% stocks, 23% bonds, 8.2% multi-asset class and his IRA holds 52.5% stocks, 25% bonds, and 22.3% multi-asset class. This asset mix closely matches “moderate” investors in early 60’s.

Nevertheless, a 20%-40% stock market correction would subject this portfolio mix to $100,000-$200,000 in potential losses. Moreover, since the bulk of the combined portfolios are in actively managed funds, the inability of managers to beat benchmarks is another element of risk.

Tax Efficiency

Minimizing the negative impact of taxes is easily accomplished by investing in tax-efficient vehicles like index ETFs and through smart asset location. Avoiding premature retirement plan distributions and 401(k) loans are other tax smart moves.

I observed no tax-efficiency problems with PLR’s combined portfolios. Well done!

Performance

Your performance return will always do one of two things; 1) validate portfolio’s design, or 2) incriminate it. And it’s how a person’s portfolio performs against to a blended index benchmark that corresponds to the person’s asset mix that reveals the unadulterated truth about performance.

PLR’s combined portfolios had a 1-year gain of $10,496 or +1.7% from 12/31/13 to 12/31/14 versus a +5.23% gain for a blended index benchmark matching their asset mix. Put another way, PLR’s underperformance of 3.5% is unsatisfactory.

The Final Grade

PLR’s final Portfolio Report Card grade is a “C.” This grade means PLR’s portfolio has meaningful structural weaknesses.

The biggest problem areas are subpar performance and minimizing investment cost. In each of these sub-graded categories, PLR’s portfolio flunked. Paying almost 2% in annual fees on an $863,309 portfolio is around $17,200. That’s far too much money to be forfeiting every year!

Likewise, it’s surprising to see that a financial advisor managed portfolio like PLR’s is under-diversified by missing exposure to major asset classes like real estate and commodities. Clearly, this particular advisor is not earning their keep.

In summary, I know that if PLR fixes the weakness that I identified inside their investment portfolio they can and will get a better grade in the future. And more importantly, they can put their investments back on track and reach their goals.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which has analyzed and graded more than $50 million. It helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.

Follow us on Twitter @ ETFguide