What does the optimal investment portfolio look like? Is it the portfolio with the hottest stocks and ETFs? Is it the portfolio managed by famous money managers?

Actually, the optimal portfolio is perfectly compatible with you. Furthermore, optimal portfolios deliberately minimize investment cost and taxes, diversify across a variety of asset classes, and deliver investment performance that matches or exceeds a blended market index.

(Audio) Listen to Ron DeLegge @ The Index Investing Show

My latest Portfolio Report Card is for A.C., a married 44-year old financial analyst from San Diego, CA. She told me her main goal is to have enough money to retire and that a little market risk doesn’t worry her because she’s got a longer-term view.

She self-manages her 401(k) plan and she considers herself an aggressive growth investor.

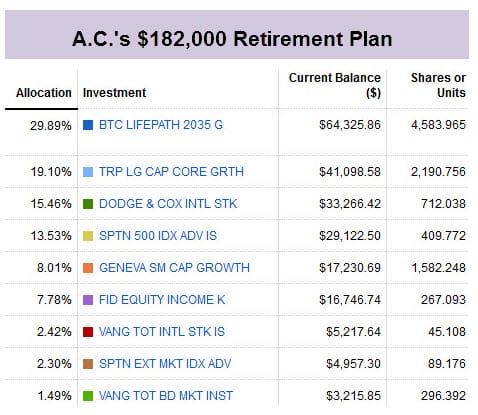

A.C. owns a total of 9 mutual funds in her $182,357 retirement plan. What kind of grade will she get for her Portfolio Report Card? Before I assign her a final grade, let’s analyze how she’s doing.

Cost

A.C.’s largest is LPJCX which charges annual expenses of 0.11%. Her other four largest holdings charge annual expenses between 0.02% up to 0.64%.

It seems like’s she made a deliberate effort to contain cost by keeping her money in the lower cost mutual fund choices within her 401(k) plan. This strategy will help her to keep more of her performance returns where they belong: in her pocket, not in someone else’s.

Diversification

Truly diversified portfolios are never concentrated in one stock or mutual fund, but rather have adequate exposure to all the core or major asset classes. How does A.C. do?

A.C.’s 401(k) account holds U.S. large-cap stocks via the Fidelity Spartan S&P 500 Fund (Nasdaq:FXAIX), small cap stocks via the Geneva Small-Cap Growth Fund, international stocks via the Dodge & Cox International Fund (Nasdaq:DODFX), and bonds via the Vanguard Total Bond Market Fund (Nasdaq:VBTIX).

Unfortunately, her portfolio owns too much of the same thing in a few places; large-cap and international stocks.

For example, her largest holding (30% of her account) is a target-date fund called the Blackrock LifePath 2035 Fund (Nasdaq:LPJCX) which already has broad exposure to domestic and international stocks along with bonds.

Yet, A.C. duplicates some of her exposure to the same asset classes held within LPJCX. In the large cap area, for instance, she owns three funds that offer exposure to these types of stocks: FXAIX, FEIKX, and the TRP Large Cap Core Growth Fund. Simply put, it’s overkill.

Lastly, A.C.’s portfolio misses exposure to major asset classes like commodities (NYSEARCA:DBC), international real estate (NYSEARCA:VNQI), and TIPS (NYSEARCA:GTIP).

Risk

A.C. described herself to me as an “aggressive growth” investor. If that’s true, then her portfolio should match that description.

Her current asset mix has 98.5% exposure to stocks and the rest to the U.S. bonds. She’s in her mid-40s which gives her a relatively long investment time horizon of 15-20 years before retiring. It also means (theoretically) she should be able to tolerate significant declines of 25% or more without panicking. This is easier said than done. And I’m not sure 98.5% exposure to a global stock market that declines 50% would sit too well with her.

There are degrees of aggressiveness and I would classify A.C.’s current asset mix as hyper-aggressive rather than just “aggressive growth.” Has her current portfolio’s asset mix overstated her true risk capacity? Unfortunately it has.

Tax-Efficiency

A.C. has no outstanding 401(k) loans which could pose a tax liability to her retirement plan if she leaves her job without paying back the loan in full.

Performance

It’s always a red-flag whenever I grade investment portfolios that are unable to match or exceed the performance of a blended mix of passive index funds or ETFs.

Over the past year, A.C.’s investment portfolio grew from $157,785 to $182,357 for a 15.5% gain. Meanwhile, a blended benchmark of passive index ETFs that reflect an aggressive investor that matches her profile gained 19.2%. Her subpar performance is unsatisfactory.

Summary

A.C.’s final Portfolio Report Card is a “C.” This is not a good grade and it means her investment plan has major structural flaws.

While she did OK on keeping the costs of her retirement plan down, her 98.5% exposure to stocks is well-beyond aggressive – it’s hyper-aggressive. Also, she’s got an over-diversified portfolio that’s cluttered with too many funds that own the same types of assets.

Finally, her sub-par one-year performance of almost 4% less versus a blended benchmark of index ETFs matching her asset mix is unacceptable.

On a positive note, A.C. still has a long-time horizon before retiring. That means the sooner she makes improvements to her portfolio, the sooner she can start seeing the positive results. The compounding effect of doing things right over a few decades is tremendous.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.