Wall Street has been so busy with one all-time high after another, many have already long-forgotten that it’s been over one-year since the stock market corrected by 10% or more. But as the great poets say, “we don’t remember the days, we only remember the moments.”

(Audio) Are ETFs turning people into day traders?

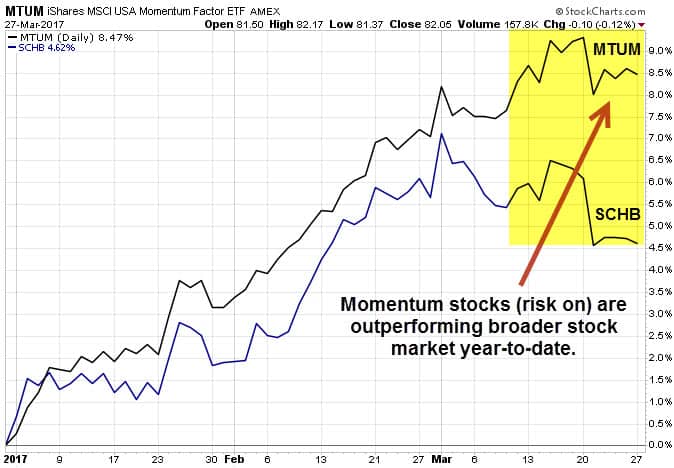

At this particular moment, the upward velocity in stock prices is fading.

Mid-cap (NYSEARCA:MDY) and small-cap U.S. stocks (NYSEARCA:IWM) have now fallen below their 50-day moving average. What does it mean? It’s a signal the upward trend in stock prices is slowing. Moreover, smaller stocks have noticeably underperformed larger, “safe” companies (NYSEARCA:VV), which is a telltale sign the market’s risk appetite for higher beta stocks is waning.

The last time stock prices corrected more than 10% was from Dec. 2015 to Feb. 2016 when U.S. stocks fell 13.3% in value. But that particular pullback – like the nine other corrections since the 2008-09 financial crisis was brief – lasting just 100 calendar days. What will a future correction look like?

Clearly, there’s no guarantee that future market corrections will be brief or that they won’t spiral into a deeper drop, known as a “bear market.” What can you do about it right now?

The prudent course of action for all investors – new and experienced – is to have an adequate margin of safety within your investment portfolio that accurately reflects your unique risk profile and investment time horizon. For example, a retired person with a lower appetite for risk should have a higher margin of safety or cushion built into their portfolio. On the other hand, a working person with a higher tolerance for risk should still have a margin of safety, but it will be smaller.

In the context of an investment portfolio, your margin of safety represents the portion of your total assets that is strictly reserved for principal protection, liquidity, and zero volatility. The very best investors always have a margin of safety within their portfolio and that’s why they’re able to capitalize from falling stock prices while the fully invested masses aren’t.

When is the ideal time to install a margin of safety or cushion within your investment portfolio? Why of course it’s when market conditions are favorable not when prices are sinking like the Titanic!

The thoughtful, proactive investor takes concrete steps to install a margin of safety before they need it. And even if they don’t end up needing or using their margin of safety just yet, they don’t lament that fact.

Both my online classes along with ETFguide PREMIUM offers a Margin of Safety worksheet to help you accurately calculate how much of your investments should be reserved for your cushion. What’s your unique number?

In summary, the fading momentum in stock prices is bad news for the institutions and individuals with overleveraged, fully invested portfolios that lack an adequate margin of safety. On the other hand, investors with an adequate margin of safety have given themselves an edge by providing themselves and their families with ample asset protection and liquidity.