Overpaying for anything is a bad idea. But it’s an especially bad thing when it comes to investing in the stock market.

James Montier at GMO correctly observes:

“Over the years I’ve witnessed many attempts by the practitioners of this most dark art to justify why tried and tested measures of valuation are no longer meaningful, or occasionally create new measures of valuation that purport to show the market to be cheap.”

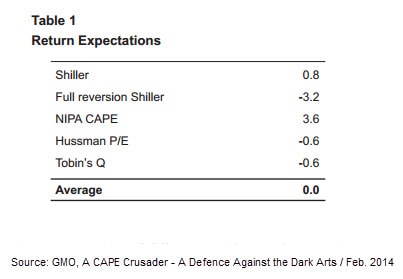

For whatever it’s worth, Montier’s latest paper examines five valuation models for estimating the performance of U.S. stocks (NYSEARCA:VTI) over the next seven years. On the optimistic side, they include the cheery NIPA CAPE, which projects an expected real return of 3.6% compared to the more sober Shiller full mean reversion model which projects a -3.2% loss.

The average blended return of all five models is zero and if the spurious NIPA-based CAPE is excluded, the average seven year return falls to almost -1%.

Even if equity valuations (NasdaqGM:QQQ) are overstretched by historical standards – and we know they are – there’s no light bulb in the stock market’s brain that suddenly triggers a major selloff because stocks are expensive.

As we’ve pointed out before, stocks do not necessarily need to be grossly overvalued before suffering a sharp setback. Have we already forgotten what happened in 2007?

AUDIO: Emerging Markets are Burning! Here’s how to Capitalize

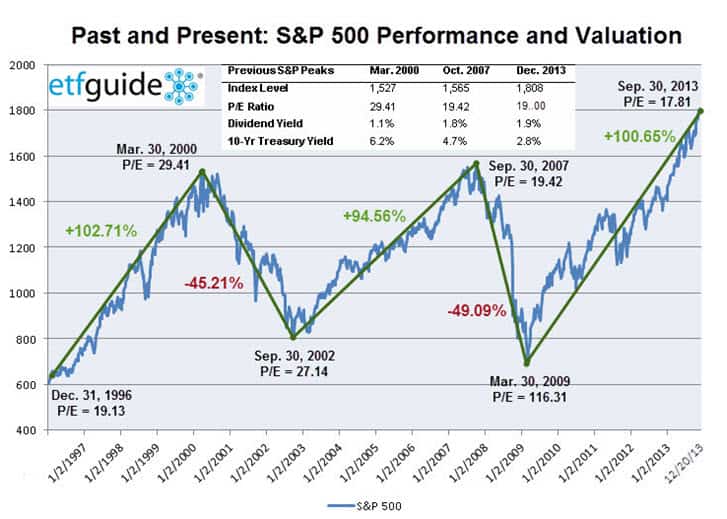

In Oct. 2007, the S&P 500’s (SNP:^GSPC) P/E ratio was just 19.42 compared to a frothy 29.41 in March 2000. By historical standards, the U.S. stock market (NYSEARCA:IVV) in the fall of 2007 was a screaming bargain compared to the stock market of 2000. But that still didn’t stop stocks from declining almost 50% over the following 18 months.

Looking back, investors that used historically cheap P/E ratios in 2007 as a reason to buy stocks (NYSEARCA:IWM) were badly misguided. Will the future be any different for people who use the same rationale as their guide?

Stock market valuations do matter, but emotion and psychology plays key roles in moving and shaping stock prices. This will always be the case so long as the stock market has greedy and fearful human participants. That’s also why a vigilant monitoring of the stock market’s mood or sentiment is a must.

The ETF Profit Strategy Newsletter uses technical, fundamental, and sentiment analysis along with market history and common sense to keep investors on the right side of the market. In 2013, 70% of our weekly ETF picks were gainers.

Follow us on Twittter @ ETFguide